Rising Energy Costs

The escalating costs of traditional energy sources are driving interest in the Polycrystalline Solar Modules Market. As fossil fuel prices fluctuate and environmental regulations tighten, consumers and businesses are increasingly seeking alternative energy solutions. The economic rationale for investing in solar energy becomes more compelling as energy prices rise. In many regions, the cost of electricity from polycrystalline solar modules is becoming competitive with or even lower than conventional energy sources. This trend is likely to encourage more consumers to consider solar installations, thereby expanding the market for polycrystalline solar modules. Additionally, as energy independence becomes a priority for many nations, the shift towards solar energy is expected to gain momentum.

Growing Environmental Concerns

Growing environmental concerns are significantly influencing the Polycrystalline Solar Modules Market. As awareness of climate change and environmental degradation increases, there is a collective push towards sustainable energy solutions. The adoption of solar energy, particularly through polycrystalline solar modules, is seen as a critical step in mitigating environmental impacts. Research indicates that solar energy can substantially reduce greenhouse gas emissions compared to fossil fuels. This heightened awareness is prompting both consumers and businesses to invest in solar technology as part of their sustainability initiatives. As environmental regulations become stricter, the demand for eco-friendly energy solutions, including polycrystalline solar modules, is expected to rise, further propelling market growth.

Government Policies and Incentives

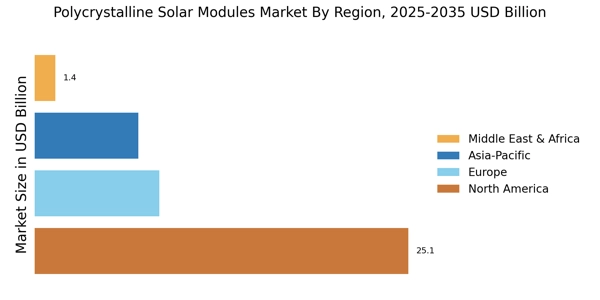

Government policies and incentives are pivotal in driving the growth of the Polycrystalline Solar Modules Market. Many countries have implemented favorable regulations and financial incentives to promote the adoption of solar energy. These include tax credits, rebates, and feed-in tariffs that encourage both residential and commercial investments in solar technology. For example, the implementation of renewable portfolio standards mandates utilities to source a certain percentage of their energy from renewable sources, thereby increasing the demand for solar modules. As of 2025, numerous nations are expected to enhance their support for solar energy, which could lead to a substantial increase in the deployment of polycrystalline solar modules, further solidifying their market position.

Increasing Demand for Renewable Energy

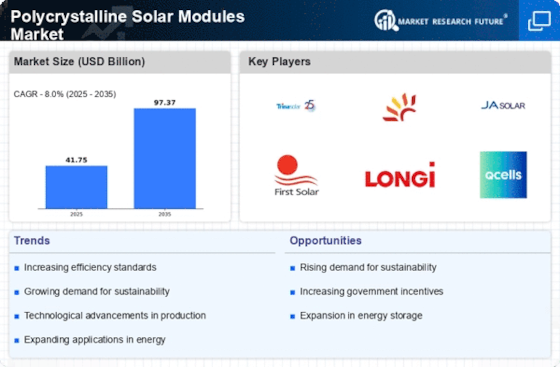

The rising demand for renewable energy sources is a primary driver for the Polycrystalline Solar Modules Market. As nations strive to reduce their carbon footprints and transition to sustainable energy solutions, solar energy has emerged as a viable alternative. The International Energy Agency indicates that solar power capacity has been expanding rapidly, with projections suggesting a significant increase in installations over the next decade. This trend is likely to bolster the demand for polycrystalline solar modules, which are known for their cost-effectiveness and efficiency. Furthermore, as energy prices fluctuate, the affordability of solar energy becomes increasingly attractive to both residential and commercial sectors, thereby enhancing the market potential for polycrystalline solar modules.

Technological Innovations in Solar Technology

Technological advancements play a crucial role in shaping the Polycrystalline Solar Modules Market. Innovations in manufacturing processes and materials have led to improved efficiency and reduced costs of polycrystalline solar modules. For instance, the development of bifacial solar panels, which can capture sunlight from both sides, has gained traction. According to recent data, the efficiency of polycrystalline modules has improved significantly, with some models achieving efficiencies above 20%. These advancements not only enhance the performance of solar panels but also contribute to a decrease in the levelized cost of electricity (LCOE), making solar energy more competitive against traditional energy sources. As technology continues to evolve, the market for polycrystalline solar modules is expected to expand further.