Top Industry Leaders in the Policy Management Telecom Market

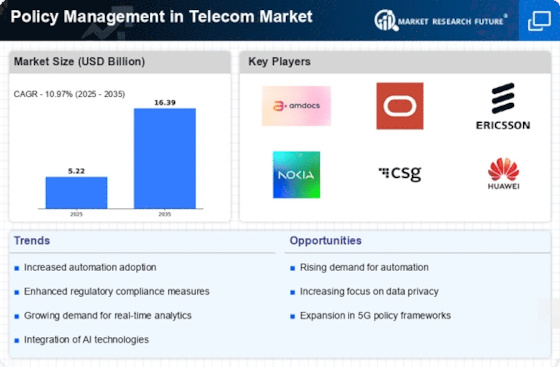

Competitive Landscape of Policy Management in Telecom Market:

The competitive landscape of policy management in the telecom market is characterized by intense rivalry among key players, each vying for a significant market share. Several factors contribute to the dynamism of this landscape, including technological advancements, regulatory changes, and evolving consumer demands. As of the latest analysis, the following key players dominate the market:

Key Players:

- LM Ericsson Telephone Company (Sweden)

- Genpact (U.S.)

- Huawei Investment & Holding Co., Ltd. (China)

- Intracom Telecom (Greece)

- Nokia Corporation (Finland)

- Wipro Limited (India)

- Amdocs Limited (U.S.)

- Comarch Sa. (Poland)

- Oracle Corporation (U.S.)

- Astea International Inc. (U.S.)

Strategies Adopted:

- Diversification of Product Portfolio: Key players are actively diversifying their product portfolios to offer comprehensive solutions, addressing not only policy management but also related aspects such as customer experience and network optimization.

- Strategic Partnerships: Collaborations and partnerships with other technology providers, content creators, and telecom operators are prevalent strategies. These alliances help in creating integrated solutions and expanding market reach.

- Focus on Innovation: To stay ahead in this competitive landscape, companies are heavily investing in research and development, introducing innovative features such as real-time policy updates, dynamic service customization, and AI-driven decision-making.

- Global Expansion: The market leaders are aggressively expanding their global footprint through acquisitions, partnerships, and strategic investments in emerging markets, where the demand for advanced policy management solutions is on the rise.

Factors for Market Share Analysis:

- Technology Integration: The extent to which policy management solutions seamlessly integrate with existing telecom infrastructure plays a crucial role in determining market share. Companies offering plug-and-play solutions are gaining traction.

- Scalability: As telecom operators expand their networks, the scalability of policy management solutions becomes paramount. Market leaders invest in scalable solutions that can adapt to the growing needs of operators.

- Compliance and Security: With increasing regulatory scrutiny, companies that prioritize compliance and offer robust security features have a competitive advantage. Assurance of data protection and regulatory compliance is a significant factor in market share analysis.

- Customer Satisfaction: The ability of policy management solutions to enhance the overall customer experience and meet evolving consumer demands directly influences market share. Positive feedback and customer retention contribute to a company's competitive position.

New and Emerging Companies:

- Openwave Mobility: This emerging player focuses on mobile data optimization and policy control solutions, catering to the evolving needs of telecom operators for efficient traffic management and improved quality of service.

- MATRIXX Software: Specializing in digital commerce solutions for telecom, MATRIXX Software is gaining attention with its innovative approach to policy management, enabling operators to monetize new services effectively.

- NetNumber Inc.: Positioned as a leading provider of centralized signaling and routing control (CSRC) solutions, NetNumber is emerging as a key player in policy management, offering operators the agility to adapt to changing market dynamics.

Current Company Investment Trends:

- 5G Infrastructure: Major investments are directed towards developing and enhancing policy management solutions that are compatible with 5G networks. Companies are positioning themselves to capitalize on the widespread adoption of 5G technology.

- Artificial Intelligence (AI) Integration: Recognizing the role of AI in optimizing policy management, companies are investing in AI-driven solutions that enhance decision-making, automate processes, and improve overall efficiency.

- Edge Computing Solutions: With the rise of edge computing in the telecom sector, companies are investing in policy management solutions that can effectively handle data processing at the edge, ensuring low latency and improved network performance.

- Cloud-Based Offerings: The shift towards cloud-based policy management solutions is evident, with companies investing in cloud infrastructure and services. This trend aligns with the industry's move towards virtualization and software-defined networking.

Latest Company Updates:

December 12, 2023: Telenor Taps Amdocs for Policy Management Transformation - Telenor, a leading Norwegian telecom operator, has partnered with Amdocs to implement a centralized policy management platform. This will enable Telenor to automate policy creation, deployment, and enforcement across its network and services, leading to improved efficiency and agility.

November 15, 2023: GSMA Launches Policy Management Framework for 5G Networks - The GSMA, a global association for mobile operators, has unveiled a new policy management framework specifically designed for 5G networks. This framework aims to provide operators with a standardized approach to managing policies across complex 5G environments, ensuring network stability and security.

October 26, 2023: US FCC Approves New Net Neutrality Rules - The US Federal Communications Commission (FCC) has adopted new net neutrality rules, prohibiting internet service providers from throttling or blocking lawful content. This policy change is expected to have a significant impact on the way telecom companies manage network traffic and prioritize data packets.

September 20, 2023: European Commission Investigates Telecom Policy Collusion - The European Commission has launched an investigation into potential collusion among major European telecom operators regarding roaming charges and data pricing. This investigation could lead to hefty fines for companies found to be in violation of competition laws.