Market Trends

Key Emerging Trends in the Point of Care Technology Market

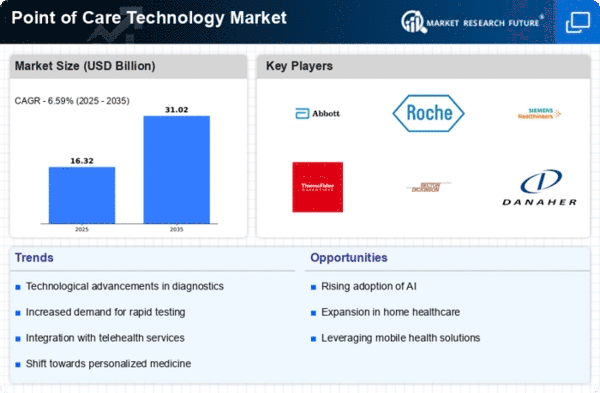

Demand for fast, decentralized diagnostic solutions has transformed the Point of Care Technology industry in recent years. This sector focuses on technology that offer immediate test results at the patient's bedside or in non-traditional healthcare settings. This market emphasizes speedy diagnoses and treatment, coinciding with the healthcare industry's goal of prompt and effective patient care. Innovative testing equipment that decrease the time between diagnosis and medical action have been developed due to this emphasis on immediacy.

The spread of Point of Care Technology applications beyond hospitals is notable.This trend toward decentralized testing improves accessibility and speeds up medical choices, ensuring patients receive timely care regardless of location or healthcare provider.

The market has been shaped by technology, notably in portable and handheld testing instruments. These tiny tools allow healthcare practitioners to test efficiently in different and dynamic contexts due to their mobility and ease. Portability is especially useful in distant or resource-limited settings, where on-site testing might improve patient outcomes.

Connectivity and data management are other Point of Care Technology trends. These technologies increasingly allow real-time data exchange between point-of-care devices and EHRs. This integration improves healthcare professional coordination by making vital information visible to patients.

Due to pandemics and outbreaks, infectious disease testing has become more popular. Point-of-care technologies are essential for speedy and accurate infectious illness diagnostics like COVID-19. This increased attention on infectious illness testing is spurring innovation and point-of-care testing acceptance.

Molecular point-of-care diagnostics is a growing market trend. Small, easy-to-use molecular testing instruments are becoming increasingly common, allowing rapid and accurate detection of disease-related genetic markers. This development might lead to tailored medicine and focused therapy, a shift toward more precise healthcare.

Point of Care Technology agreements are growing. Healthcare organizations, technology developers, and diagnostic firms form strategic partnerships to exchange resources, knowledge, and accelerate point-of-care technology development and implementation. This collaborative approach creates an ecosystem for innovation and rapid healthcare workflow technology adoption.

Point of Care Technology is growing worldwide, both in developed and developing countries. Their flexibility makes them useful in various clinical settings, adding to their global adoption.

Leave a Comment