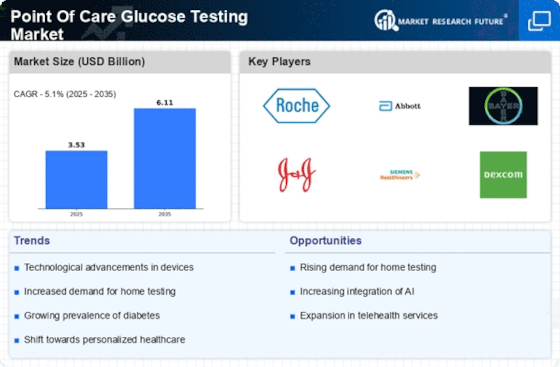

Point Of Care Glucose Testing Size

Point Of Care Glucose Testing Market Growth Projections and Opportunities

The market for Point of Care Glucose Testing (POCT) is driven by the rising pervasiveness of diabetes around the world, which requires helpful and speedy glucose testing arrangements. As the commonness of diabetes expands, there is a developing accentuation on the POCT to speedily and promptly evaluate blood glucose levels. Developments in glucose observing gadgets innovation, including CGM frameworks, handheld meters, and cell phone coordinated arrangements, are essentially affecting the POCT glucose testing market. These headways work on the exactness of glucose testing and improve the patient experience through the arrangement of cutting-edge data. In vitro diagnostics, including glucose testing gadgets, are significantly impacted by the administrative climate. Guaranteeing tests stick to thorough guidelines is critical for laying out certainty among medical services suppliers and patients, as it influences endorsement, commercialization, and clinical reception by advancing accuracy, trustworthiness, and wellbeing. Reception of POCT glucose testing is impacted by repayment strategies, financial variables, and medical services foundation in different districts; accordingly, market members should adjust to explicit hindrances. Continuous innovative work pushes the POCT glucose testing market, as demonstrative organizations give a variety of arrangements that display improved accuracy and ease of use, in this manner empowering development. Market development is moved by global associations among demonstrative associations, research foundations, and medical care associations. These coordinated efforts produce novel glucose detecting advances, upgrade testing calculations, and further develop network arrangements that are explicitly intended for diabetes the board. This collaboration facilitates the movement of POCT glucose checking. Glucose testing arrangements that focus on exactness, client accommodation, inconvenience decrease, and ease of use are acquiring portion of the overall industry. Ideal POCT glucose testing arrangements that stick to this worldview upgrade the experience of overseeing diabetes. The reception of POCT glucose testing is considerably affected by open mindfulness and instruction crusades, which engage people to oversee diabetes and advance the test's advantages; subsequently, this increments request among medical care experts and patients. Consolidating telemedicine and advanced wellbeing arrangements into POCT glucose testing is adding to the market's extension. As medical services frameworks utilize more associated checking approaches, this reconciliation further develops the general consideration continuum for people with diabetes and builds the productivity of diabetes management.

Leave a Comment