Market Share

Pharmacy Benefit Management Services Market Share Analysis

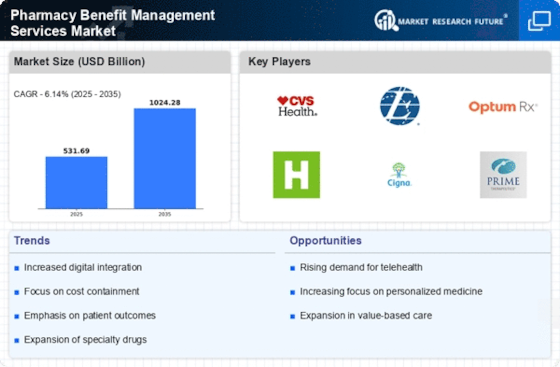

The Pharmacy Benefit Management Services (PBMS) marketplace is an essential component of the healthcare atmosphere, facilitating the management of prescription drug advantages. Effective market percentage positioning strategies are critical for groups working in this dynamic zone. Staying aggressive calls for continuous technological innovation. Companies in the PBMS sector leverage superior virtual solutions, such as cellular apps and online portals, to streamline prescription techniques, decorate person revel in, and differentiate their services in the market. Recognizing the range of clients in the healthcare landscape, PBMS companies tailor advantage plans to fulfill the unique wishes of various corporations. Customization for employers, health plans, and government entities facilitates the capture of market percentages with the aid of addressing specific necessities and choices. Collaborations with coverage payers, healthcare vendors, and pharmaceutical producers are important for PBMS businesses. These partnerships beautify marketplace visibility, make bigger provider services, and contribute to the overall performance of prescription advantage control. The PBMS market is not restrained to a particular area, prompting businesses to pursue worldwide growth. Establishing a presence in international markets requires cautious attention to regional regulations, compliance standards, and models for numerous healthcare systems. Leveraging information analytics is fundamental for success in the PBMS market. Companies put money into sophisticated analytics tools to analyze prescription developments, song market dynamics, and discover possibilities for optimizing advantage plans and enhancing carrier transport. PBMS vendors prioritize affected person training to promote medication adherence and ordinary health outcomes. Investing in engagement programs, informational sources, and support services enables building trust and positions agencies as advocates for affected persons' well-being. Recognizing the cost pressures confronted by means of customers in the healthcare enterprise, PBMS companies undertake pricing techniques that provide price-effective solutions without compromising on quality. Competitive pricing and transparent rate systems are pivotal for gaining market share, specifically in value-aware markets. The PBMS market is a problem with evolving healthcare guidelines and compliance requirements. Successful agencies stay proactive, adapting their offerings to conform with the brand new rules, which not only facilitates market entry but also builds consideration amongst customers. Increasingly, groups in all sectors are specializing in environmental sustainability. In the PBMS market, adopting green practices in operations and selling sustainable pharmaceutical practices can contribute to an advantageous marketplace image, particularly for clients and companions with environmental worries.

Leave a Comment