Regulatory Support and Initiatives

Regulatory support plays a crucial role in the advancement of the Market. Governments and health authorities are increasingly recognizing the importance of Pharmacogenomics (PGx) in improving healthcare outcomes. Initiatives such as the FDA's guidance on pharmacogenomic biomarkers are fostering an environment conducive to innovation. These regulations encourage pharmaceutical companies to incorporate genetic testing into drug development processes, thereby streamlining the approval of personalized therapies. Furthermore, the establishment of reimbursement policies for Pharmacogenomics Technology tests is likely to enhance accessibility for patients. As a result, the Market is expected to expand, driven by supportive regulatory frameworks that promote the integration of genetic insights into clinical practice.

Growing Demand for Targeted Therapies

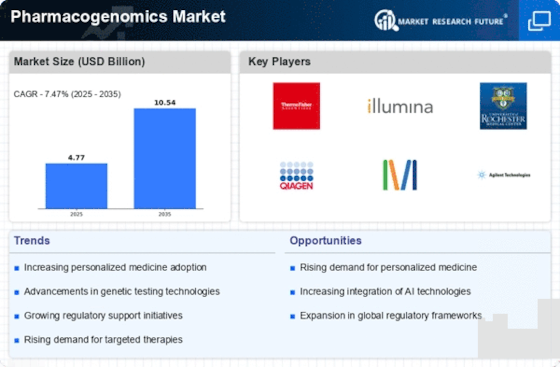

The rising demand for targeted therapies is a pivotal driver in the Pharmacogenomics (PGx) Market. As healthcare shifts towards personalized medicine, the need for treatments tailored to individual genetic profiles becomes increasingly apparent. This trend is underscored by the fact that approximately 70% of new drugs are designed to target specific genetic mutations. Consequently, pharmaceutical companies are investing heavily in Pharmacogenomics Technology research to develop therapies that align with patients' genetic makeups. This not only enhances treatment efficacy but also minimizes adverse drug reactions, thereby improving patient outcomes. The Market is likely to witness substantial growth as healthcare providers and patients alike recognize the benefits of these tailored approaches.

Rising Prevalence of Genetic Disorders

The increasing prevalence of genetic disorders is a significant driver of the Pharmacogenomics (PGx) Market. With an estimated 1 in 10 individuals affected by a genetic condition, the demand for effective diagnostic and therapeutic solutions is surging. Pharmacogenomics Technology offers the potential to identify the most effective treatments based on an individual's genetic profile, thereby addressing the unique challenges posed by these disorders. The market for pharmacogenomic testing is projected to grow at a compound annual growth rate of over 10% in the coming years, reflecting the urgent need for personalized approaches in managing genetic diseases. This trend underscores the critical role of Pharmacogenomics (PGx) in enhancing patient care and treatment outcomes.

Advancements in Bioinformatics and Data Analytics

Advancements in bioinformatics and data analytics are transforming the Market. The ability to analyze vast amounts of genetic data has become increasingly sophisticated, enabling researchers to uncover insights that were previously unattainable. This technological evolution facilitates the identification of genetic variants associated with drug response, thereby enhancing the development of personalized therapies. Moreover, the integration of artificial intelligence and machine learning in pharmacogenomic research is likely to accelerate the discovery of novel biomarkers. As a result, the Pharmacogenomics Technology is poised for growth, driven by the continuous evolution of data analytics tools that enhance the understanding of genetic influences on drug efficacy.

Increasing Awareness Among Healthcare Professionals

Increasing awareness among healthcare professionals regarding the benefits of Pharmacogenomics (PGx) is a vital driver in the Market. As medical education incorporates genetic principles into curricula, clinicians are becoming more adept at utilizing pharmacogenomic information in their practice. This heightened awareness is leading to more informed prescribing practices, ultimately improving patient outcomes. Surveys indicate that over 60% of healthcare providers believe pharmacogenomic testing can enhance treatment decisions. Consequently, the demand for pharmacogenomic services is likely to rise, as healthcare professionals seek to leverage genetic insights to optimize therapy. This trend is expected to propel the Market forward, as the integration of Pharmacogenomics (PGx) into routine clinical practice becomes more prevalent.