Pharmaceutical Warehousing Size

Pharmaceutical Warehousing Market Growth Projections and Opportunities

The pharmaceutical warehousing market is driven by a kaleidoscope of influencers who shape the overall market structure and its growth pattern through various mechanisms. Intensifying international requirements for pharmaceutical products is another major market variable. As the world population and ageing population keep on increasing, the demand too for healthcare and medications is consequently on the increase. Such increase in demand for medicine sends the rift in the pharmaceutical warehousing and facilitates the demand for effective storage, handling and distribution of drugs.

In addition, stringent regulatory conditions are shaping the pharmaceutical storage market in accordance with the market. The pharmaceutical industry is governed under strict regulatory frameworks to guarantee the safety and efficacy of all drugs. Storage facilities are bound to apply the Good Distribution Practice (GDP) norms and even other regulatory standards to ensure the intactness of pharmaceuticals until the arrival ends. While fulfilling the legal requirements alone without producing trust among stakeholders and consumers may not only be legal but also very risky.

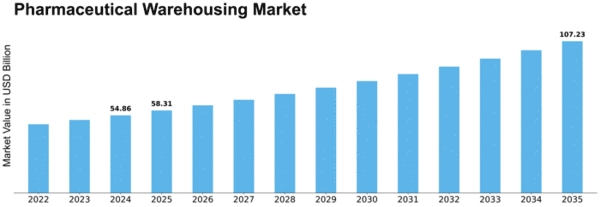

The size of the market of pharmaceutical warehousing was the sum of 48.57 billion in 2022. It is expected that the pharmaceutical and medical warehouse market will be USD 51.62 billion in 2023 and USD 89.31 billion in 2032, at an average annual growth rate (AAGR) of 6.28 %.

One of the other fundamental factors of market that influences the pharmaceutical warehousing is an advancement of technology. The way that automation, robotics, and digital systems had been utilized made storage operations more advanced. Automated storage and retrieval systems, sensors for temperature control and real-time tracking systems have somewhat increased the productiveness, accuracy and safety of drug storages. With the help of IT the current processes in operations are improved and the costs are reduced whereas overall management of the supply chain is facilitated.

The spread of globalization and the development of pharmaceutical companies into the new markets are the multi-faceted factors of the pharmaceutical warehousing business. The more companies expand onto the global platform, the more diverse the regulatory fields, the different logistical difficulties, and distinct requirements of the market they get to face. This obliges the creation of well located depots and distribution centers to facilitate cheaper and immediate delivery of the pharmaceutical products.

Market competition, which pushes the strategies applied by pharmaceutical warehousing providers, is the main driving force of this issue. In this highly competitive scenario, companies hope to set themselves apart by offering extra services like temperature controlled storage, fast response to the market demand through the use of inventory management, and personalized packaging. Through the project, a competitive environment has been created that stimulates innovation in the warehousing area and motivates providers to follow up on the new developments and future technologies.

Leave a Comment