Ph Sensor Size

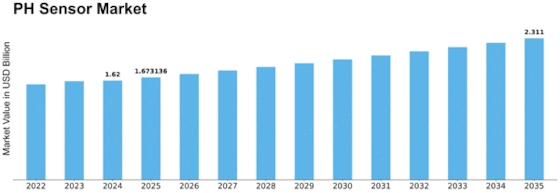

pH Sensor Market Growth Projections and Opportunities

The PH Sensor market is significantly influenced by various factors that collectively shape its growth and market dynamics. One of the primary drivers is the increasing awareness and emphasis on water quality monitoring across industries. With increased concerns about environmental impact and public health, there is an increasing demand for precise measurement of the pH values in water. This is where such PH sensors play an important role in providing real-time data for various applications in water treatment plants, agriculture and also industrial processes. The demand for water quality monitoring, due to regulatory compliance and sustainability targets is fueling the growth of PH sensor market.

Further, the increasing variety of applications for PH sensors across different industries drives market growth. Apart from classic applications used in water analysis, PH meters are found to be useful for pharmaceutical industry, food and the biotechnology. These sensors help to keep the pH levels optimal in different processes thereby ensuring quality and standardized products. The flexibility of PH sensors and their adoption in various industries fuels the market’s growth by businesses comprehending how accurate pH measurement helps maintain product quality while operating effectively.

The emphasis of precision agriculture at the global level is another important contributing aspect in regard to PH sensor market. With agriculture becoming data-driven, farmers and agribusinesses use PH sensors to determine soil acidity; thus allowing for accurate adjustments that maximize the growth of crops. The importance of PH sensors as a tool in modern farming techniques is further emphasized by the demand to apply sustainable and efficient practices.

In addition, progresses in sensor technology such miniaturization and wireless connectivity contribute to the market growth. Cheaper, less cumbersome models of PH sensors are being manufactured and this makes them available to a greater majority. The device integration with wireless communication enables real-time monitoring and information gathering, thus improving the overall efficiency of processes that require accurate pH measurements.

Various government regulations and initiatives in relation to environmental monitoring and standards of water quality also plays an important function that influences on the PH sensor market. Demands for reliable pH measurement solutions are increased by regulations of the industries to monitor and keep certain pH standards in effluents and discharges.

The sensor market has various competitive dynamics such as mergers, acquisitions and partnership that influence market trends. The major players enter into strategic partnerships to increase their product lines and strengthen the technological competencies. This creates innovation and the competitive nature in markets as firms come together to respond appropriately to changing needs by various end-users across different sectors.

Although the market drivers are positive, these challenges can affect widespread adoption—calibration issues, sensor drift and mandatory maintenance. Manufacturers addressing these challenges by developing more reliable and durable PH sensors stand to gain a competitive advantage. Overcoming these hurdles is crucial for the sustained growth of the PH sensor market, ensuring that end-users can consistently rely on accurate pH measurements for their applications.

Leave a Comment