Market Analysis

In-depth Analysis of PEGylated Drugs Market Industry Landscape

The expansion of research and development efforts in the pharmaceutical and biotechnology sector, aimed at addressing the increasing requirements for treating various chronic diseases, is fueling the growth of the PEGylated drugs market. A survey conducted among members of the Pharmaceutical Research and Manufacturers of America (PhRMA) revealed substantial investments in research and development. In 2017, PhRMA member companies collectively invested a noteworthy USD 71.4 billion in R&D. Notably, the majority of this R&D spending, estimated at USD 90 billion, came from the United States.

Highlighting the global scope of these efforts, the Association of the British Pharmaceutical Industry (ABPI) invested over USD 418 million in the UK alone for research and development. Their focus was on seeking breakthroughs for conditions like cancer, dementia, and rare genetic diseases. Similarly, the Australian government allocated over USD 174.8 million in 2017 for cancer research and development, as reported by the National Health and Medical Research Council. This significant increase in research and development activities within the healthcare sector is contributing to the upward trajectory of PEGylation technology.

The advancements in research and development within the pharmaceutical industry play a pivotal role in propelling the growth of the PEGylated drugs market. These efforts are a response to the growing demand for effective treatments for chronic diseases, and they signify a commitment to discovering innovative solutions to address the complexities of various health conditions.

The investment figures provided by PhRMA underscore the substantial financial commitment made by pharmaceutical companies towards advancing healthcare solutions. The focus on research and development is not limited to a single region, as evidenced by the global investments reported by ABPI and the Australian government. This concerted effort reflects the recognition of the challenges posed by chronic diseases and the determination to find solutions that can make a positive impact on patients' lives.

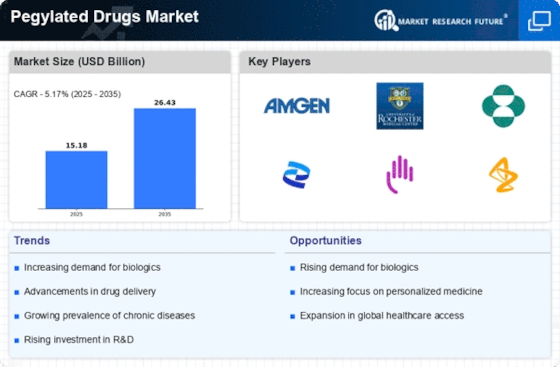

As the pharmaceutical and biotechnology industry continues to channel significant resources into research and development, the resulting innovations are driving the growth of the PEGylated drugs market. PEGylation technology, in particular, is gaining prominence due to its ability to enhance drug delivery and improve the efficacy of treatments. The market's upward trajectory is a testament to the transformative impact of ongoing research and development initiatives in the field of healthcare.

In conclusion, the surge in research and development activities within the pharmaceutical and biotechnology industry is a key driver behind the growth of the PEGylated drugs market. The substantial investments made by organizations globally underscore a commitment to addressing the challenges posed by chronic diseases. As advancements in healthcare solutions continue to emerge, propelled by dedicated research and development efforts, PEGylation technology is positioned for increased adoption, offering promising outcomes for the treatment of various health conditions. The ongoing commitment to innovation signals a positive trajectory for the PEGylated drugs market, driven by the collective efforts to enhance the quality of healthcare worldwide.

Leave a Comment