Increased E-commerce Adoption

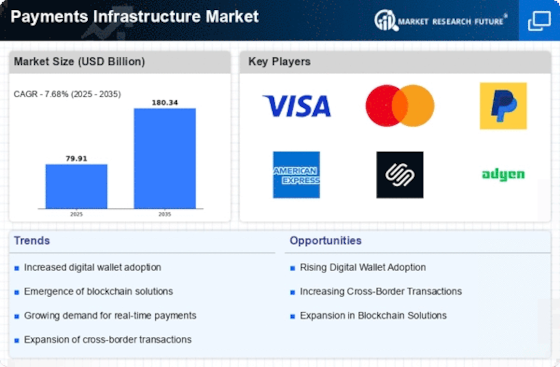

The Payments Infrastructure Market is experiencing a notable surge due to the rapid adoption of e-commerce platforms. As consumers increasingly prefer online shopping, businesses are compelled to enhance their payment systems to accommodate this shift. In 2025, it is estimated that e-commerce sales will reach approximately 6 trillion USD, necessitating robust payment infrastructures that can handle high transaction volumes efficiently. This trend indicates a growing demand for seamless payment solutions, which are essential for improving customer experience and driving sales. Consequently, companies are investing in advanced payment technologies to ensure they remain competitive in this evolving landscape.

Emergence of Contactless Payments

The Payments Infrastructure Market is witnessing a transformative shift with the rise of contactless payment methods. As consumers increasingly favor convenience and speed, contactless transactions are becoming a preferred choice for both in-store and online purchases. In 2025, it is projected that contactless payments will account for over 30% of all transactions, prompting businesses to adapt their payment infrastructures accordingly. This trend not only enhances the customer experience but also reduces transaction times, thereby increasing overall efficiency. As a result, companies are investing in technologies that support contactless payments, further driving growth in the Payments Infrastructure Market.

Regulatory Compliance and Standards

The Payments Infrastructure Market is significantly influenced by the need for compliance with evolving regulatory frameworks. Governments and financial authorities are implementing stringent regulations to enhance consumer protection and ensure secure transactions. For instance, the Payment Services Directive 2 (PSD2) in Europe mandates stronger customer authentication, which compels payment service providers to upgrade their infrastructures. This regulatory environment creates opportunities for innovation in payment solutions, as companies strive to meet compliance requirements while maintaining operational efficiency. The ongoing evolution of regulations is likely to drive investments in payment technologies that align with these standards.

Growing Demand for Cross-Border Transactions

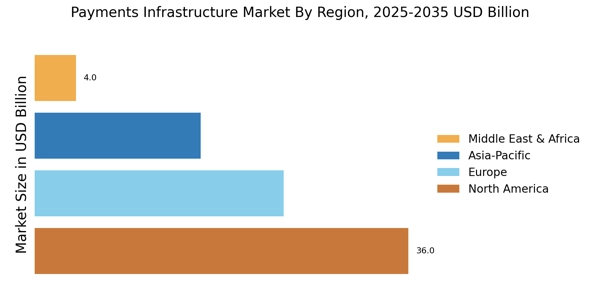

The Payments Infrastructure Market is increasingly shaped by the rising demand for cross-border transactions. As businesses expand their reach internationally, the need for efficient and cost-effective payment solutions becomes paramount. In 2025, it is expected that cross-border e-commerce will surpass 1 trillion USD, highlighting the necessity for payment infrastructures that can facilitate seamless international transactions. This trend encourages payment service providers to develop solutions that address currency conversion, regulatory compliance, and transaction speed. Consequently, the Payments Infrastructure Market is likely to see significant growth as companies strive to meet the needs of a more interconnected global economy.

Technological Advancements in Payment Solutions

The Payments Infrastructure Market is being propelled by rapid technological advancements that enhance payment solutions. Innovations such as blockchain technology, artificial intelligence, and machine learning are revolutionizing how transactions are processed and secured. For instance, blockchain offers increased transparency and security, while AI can optimize fraud detection and customer service. In 2025, it is anticipated that investments in payment technology will exceed 100 billion USD, reflecting the industry's commitment to adopting cutting-edge solutions. These advancements not only improve operational efficiency but also foster consumer trust, which is crucial for the sustained growth of the Payments Infrastructure Market.