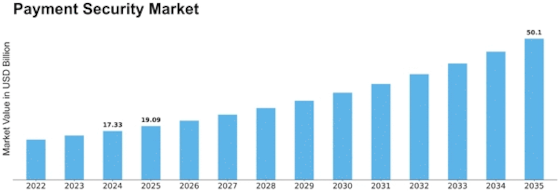

Payment Security Size

Payment Security Market Growth Projections and Opportunities

The Payment Security Market is a rapidly growing sector that focuses on providing secure payment solutions to individuals and businesses. As the industry expands, companies are constantly seeking effective market share positioning strategies to gain a competitive edge.

One common strategy is differentiation. Companies in the Payment Security Market strive to differentiate themselves from their competitors by offering unique features or services. For example, some companies may specialize in providing advanced encryption technology to protect sensitive customer data, while others may focus on offering comprehensive fraud detection and prevention systems. By highlighting these distinctive features, companies can attract customers who prioritize specific security measures, ultimately increasing their market share.

Another popular strategy is cost leadership. Some companies in the Payment Security Market aim to offer their services at a lower price compared to their competitors. This strategy appeals to cost-conscious customers who prioritize affordability. By leveraging economies of scale and adopting efficient processes, companies can reduce their costs and pass on the savings to their customers. This approach helps these companies capture a larger market share, particularly among price-sensitive customers.

Companies in the Payment Security Market also employ a strategy known as niche marketing. Rather than targeting a broad customer base, niche marketing involves focusing on a specific segment of the market with unique needs or preferences. For instance, a company may specialize in providing payment security solutions for small businesses or e-commerce platforms. By catering to the specific requirements of these niche segments, companies can establish themselves as experts in their respective fields and capture a significant share of the target market.

Collaboration and partnerships are also vital market share positioning strategies in the Payment Security Market. Companies often collaborate with other organizations to offer integrated solutions that combine payment security with other services. For example, a payment processing company may partner with a fraud detection software provider to offer a comprehensive payment security package. By leveraging each other's strengths, companies can provide customers with a more holistic solution, enhancing their market share and customer loyalty.

Furthermore, continuous innovation is crucial in the Payment Security Market. Companies must constantly evolve their products and services to keep up with emerging threats and changing customer demands. This can involve investing in research and development to develop cutting-edge security technologies or enhancing existing solutions based on customer feedback. By staying at the forefront of innovation, companies can position themselves as leaders in the market and attract customers seeking the latest and most effective payment security solutions.

Leave a Comment