Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is a significant driver in the Payment Analytics Software Market. Organizations are increasingly adopting cloud technologies to enhance scalability, flexibility, and cost-effectiveness. The market for cloud-based payment analytics software is anticipated to grow at a rate of around 18% annually, as businesses seek to reduce infrastructure costs and improve accessibility. Cloud solutions enable real-time data processing and analytics, allowing organizations to respond swiftly to market changes. This trend not only streamlines operations but also empowers businesses to leverage advanced analytics capabilities without the burden of extensive on-premises infrastructure, thereby transforming the Payment Analytics Software Market.

Increased Focus on Fraud Detection

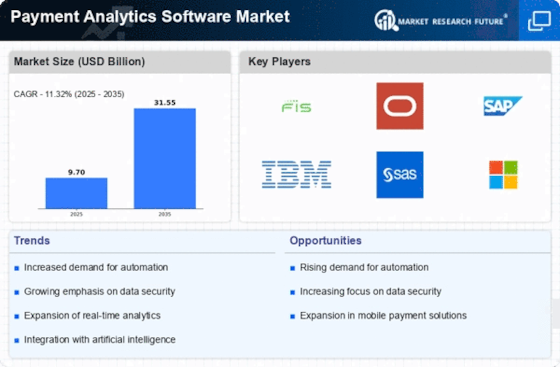

Fraud detection remains a critical concern within the Payment Analytics Software Market. As digital transactions proliferate, the potential for fraudulent activities escalates, prompting organizations to invest in advanced analytics solutions. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 12% over the next five years. Payment analytics software equipped with sophisticated algorithms can identify suspicious patterns and flag potential fraud in real-time, thereby safeguarding financial assets. This heightened focus on fraud detection not only enhances security but also fosters consumer trust, further driving the demand for payment analytics solutions.

Integration with E-commerce Platforms

The Payment Analytics Software Market is increasingly influenced by the integration of analytics tools with e-commerce platforms. As online shopping continues to expand, businesses are seeking ways to optimize their payment processes and enhance customer satisfaction. The integration of payment analytics software with e-commerce systems allows for seamless transaction tracking and analysis. This trend is expected to contribute to a market growth rate of approximately 14% in the coming years. By leveraging insights gained from payment data, organizations can refine their marketing strategies, improve conversion rates, and ultimately drive revenue growth, making this integration a pivotal driver in the Payment Analytics Software Market.

Rising Demand for Data-Driven Insights

The Payment Analytics Software Market experiences a notable surge in demand for data-driven insights. Organizations increasingly recognize the value of leveraging analytics to enhance decision-making processes. This trend is evidenced by a projected growth rate of approximately 15% annually, as businesses seek to optimize payment processes and improve customer experiences. The ability to analyze transaction data in real-time allows companies to identify trends, detect anomalies, and make informed strategic decisions. Consequently, the Payment Analytics Software Market is witnessing a shift towards solutions that provide comprehensive analytics capabilities, enabling organizations to harness the power of their data effectively.

Growing Emphasis on Customer Experience

Enhancing customer experience is a paramount focus within the Payment Analytics Software Market. Organizations are increasingly recognizing that a seamless payment experience is crucial for customer retention and satisfaction. The market is projected to grow by approximately 16% over the next few years, driven by the need to analyze customer behavior and preferences. Payment analytics software enables businesses to gather insights into customer interactions, identify pain points, and tailor their offerings accordingly. By leveraging these insights, organizations can create personalized experiences that foster loyalty and drive repeat business, underscoring the importance of customer-centric strategies in the Payment Analytics Software Market.