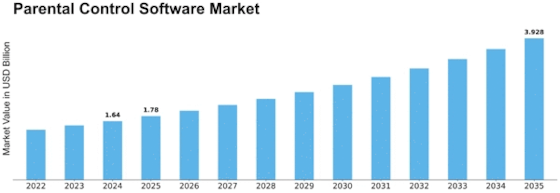

Parental Control Software Size

Parental Control Software Market Growth Projections and Opportunities

The US Parental Control Software Market has experienced a notable surge in demand, underpinned by the evolving dynamics of parenting in the digital age and an increasing awareness of the need to safeguard children's online experiences. The period from 2018 to 2023 has seen a steady rise in the adoption of Parental Control Software, driven by the proliferation of digital devices among children and the growing concerns regarding online safety. One of the key indicators of the market's growth is the Compound Annual Growth Rate (CAGR) witnessed during this period. The CAGR reflects the annual growth rate of the market over a specified time frame, providing insights into the market's sustained expansion. In the context of the US Parental Control Software Market from 2018 to 2023, the CAGR signifies a consistent upward trajectory in demand. The increasing ubiquity of smartphones, tablets, computers, and smart TVs among children has necessitated a comprehensive approach to digital parenting. Parental Control Software has emerged as a solution that empowers parents to manage their children's online activities effectively. The market has responded to the rising demand for features such as content filtering, time management, and activity monitoring, providing parents with the tools needed to create a safer digital environment. The CAGR during this period is a testament to the market's resilience and its ability to adapt to the changing landscape of technology and parenting. The digitalization of education, entertainment, and social interactions, particularly accelerated by the COVID-19 pandemic, has further underscored the importance of robust parental control measures. The market's growth is not only attributed to the increasing number of connected devices but also to the heightened awareness among parents regarding the potential risks associated with unrestricted online access. Cyberbullying, exposure to inappropriate content, and concerns about screen time have become focal points for parents, driving them to seek comprehensive solutions offered by Parental Control Software. As the market continues to mature, it is likely to witness innovations and enhancements in software functionalities. Integrations with emerging technologies, adaptability to the Internet of Things (IoT) landscape, and more sophisticated features are expected to characterize the next phase of growth for Parental Control Software. the US Parental Control Software Market has experienced robust demand from 2018 to 2023, as reflected in the positive CAGR. This growth is attributed to the evolving challenges of parenting in the digital era, the proliferation of digital devices among children, and an increased consciousness about the importance of ensuring a safe and secure online environment for the younger generation. As technology continues to advance, the market is poised for further expansion, catering to the dynamic needs of modern parenting.

Leave a Comment