Top Industry Leaders in the Paralleling Switchgear Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

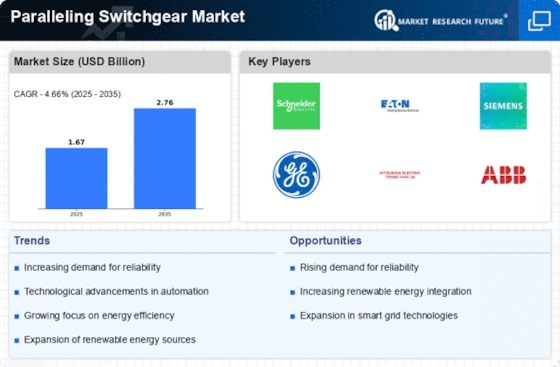

Competitive Landscape of the Paralleling Switchgear Market: Navigating a Dynamic Terrain

Key Players and Strategies:

Global Giants: Leading the charge are established players like ABB, Siemens, Eaton, and Schneider Electric. These companies leverage their extensive product portfolios, strong brand recognition, and global reach to maintain market dominance. Their strategies pivot around continuous innovation, strategic acquisitions, and expanding service offerings. ABB, for instance, collaborated with Hitachi to develop SF6-free switchgear technology, a game-changer for environmental sustainability.

Regional Specialists: Regional players like Russelectric (US), Itec (China), and Fuji Electric (Japan) cater to specific geographic demands and offer cost-competitive solutions. They capitalize on their deep understanding of local regulations and customer preferences, building strong footholds in their respective markets. Itec, for example, focuses on developing compact and modular switchgear designs ideal for space-constrained applications in Asia.

Emerging Challengers: New entrants like Elara Switchgear and Green Switchgear bring fresh perspectives and disruptive technologies. They focus on niche applications, like renewable energy integration, and leverage digital connectivity and automation features to differentiate themselves. Elara Switchgear's cloud-based monitoring platform caters to the growing demand for remote management and predictive maintenance in distributed generation setups.

Market Share Analysis:

Factors influencing market share dynamics include:

Product Portfolio Breadth: Offering a diverse range of switchgear solutions catering to various voltage levels, applications (standby, peak shave, prime power), and end-user segments (industrial, commercial, utilities) expands market reach.

Technological Prowess: Continuous investment in R&D leads to innovative features like improved safety, automation, and efficiency, giving a competitive edge. Hitachi-ABB's development of fault-tolerant paralleling algorithms exemplifies this approach.

Geographical Presence: A strong global footprint with manufacturing and distribution networks across key regions like North America, Europe, and Asia Pacific facilitates faster delivery and market responsiveness.

Brand Reputation and Service Quality: Established brands with reliable after-sales service and technical support inspire customer trust and loyalty, solidifying market positions. Schneider Electric's focus on comprehensive customer service programs is a testament to this strategy.

New and Emerging Trends:

Digitalization and Smart Grid Integration: Integrating intelligent features like data analytics, remote monitoring, and grid communication capabilities enhances switchgear functionality and optimizes grid operations. Siemens' SENTRON PAC system exemplifies this trend.

Focus on Sustainability: Eco-friendly solutions like SF6-free alternatives and energy-efficient designs are gaining traction due to stricter environmental regulations and growing pressure for carbon neutrality. Eaton's focus on green switchgear technologies highlights this shift.

Modular and Compact Designs: Space-constrained applications, especially in urban settings, necessitate compact and modular switchgear solutions. This trend opens opportunities for specialized players like Elara Switchgear.

Distributed Generation and Microgrids: The rise of renewable energy and microgrids creates demand for smaller, distributed switchgear solutions with grid synchronization capabilities. Green Switchgear's focus on microgrid applications illustrates this trend.

Overall Competitive Scenario:

The paralleling switchgear market remains competitive, with established players facing challenges from regional specialists and innovative new entrants. Continuous technological advancements, shifting customer preferences toward digitalization and sustainability, and the evolving energy landscape will shape the competitive landscape in the coming years. Success lies in adapting to these trends, focusing on niche applications, and delivering compelling value propositions to stay ahead of the curve.

While this provides a broad overview of the competitive landscape, remember that any detailed analysis necessitates considering specific segments within the market (voltage level, application, end-user) and individual company strategies. This will enable you to gain a deeper understanding of the competitive dynamics influencing particular segments and tailor your strategies accordingly.

General Electric Company (GE):

• Oct 26, 2023: GE Renewable Energy announced advancements in its grid automation solutions, including enhanced paralleling capabilities for its Cypress platform. (Source: GE press release)

Caterpillar Inc.:

• Nov 15, 2023: Caterpillar launched its latest line of Cat® diesel generator sets designed for seamless paralleling operation and improved grid integration. (Source: Caterpillar press release)

Cummins Inc.:

• Dec 5, 2023: Cummins Power Generation introduced its QSX15G natural gas generator, featuring advanced paralleling control for precise load sharing and optimal performance. (Source: Cummins press release)

Rolls-Royce (MTU Onsite Energy):

• Oct 19, 2023: MTU Onsite Energy presented its latest mtu Energy Management System with enhanced paralleling functionalities for microgrid applications. (Source: MTU press release)

Top listed global companies in the industry are:

General Electric Company (U.S.)

Caterpillar Inc. (U.S.)

Cummins Inc. (U.S.)

Rolls-Royce (MTU Onsite Energy) (U.K.)

Kohler Co. (U.S.)

Pioneer Power Solutions. (U.S.)

Regal Beloit Corporation (U.S.)

Schneider Electric SE. (France)

Advanced Power Technologies. (U.S.)

Enercon Engineering (U.S.)

Industrial Electric Mfg (U.S.)

Russelectric Inc. (U.S.)