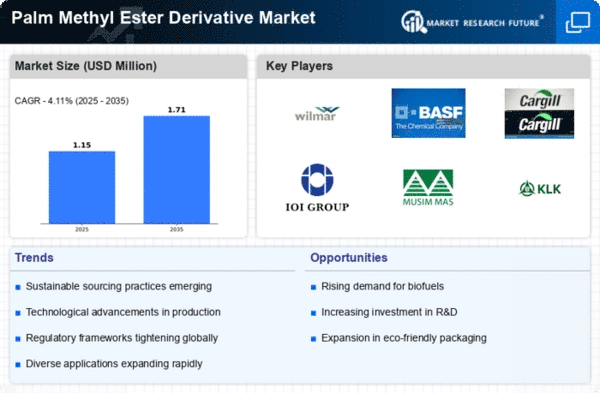

Top Industry Leaders in the Palm Methyl Ester Derivative Market

The Palm Methyl Ester Derivative Market is experiencing significant growth due to increasing demand for sustainable and bio-based products. Derived from palm oil, these derivatives find applications in various industries such as cosmetics, pharmaceuticals, and food processing. The market is driven by growing environmental concerns and regulations promoting the use of eco-friendly alternatives. Additionally, technological advancements and innovation in production processes further propel market expansion.

Key Players and Strategies:

Several established and emerging players compete in the PMED market. Here are some prominent ones and their strategic approaches:

-

The Procter & Gamble Company (US): P&G leverages its extensive brand portfolio and research capabilities to develop innovative PMED-based personal care products, catering to the growing demand for natural ingredients. -

Wilmar International Ltd (Singapore): Wilmar, a leading palm oil processor, integrates vertically to ensure consistent PMED supply and cost control. They also focus on expanding their product portfolio and geographical reach. -

KLK OLEO (Malaysia): KLK OLEO, a major Malaysian player, emphasizes sustainability practices throughout their PMED production chain. They invest in green technologies and certifications to cater to environmentally conscious consumers. -

Emery Oleochemicals (US): Emery Oleochemicals focuses on delivering high-quality PMEDs with consistent performance. They prioritize technical support and customer service to build strong relationships with manufacturers across various end-use industries. -

Music Mas (Singapore): Music Mas, a rising player, capitalizes on its agility and cost-effective production processes to gain market share. They focus on specific PMED derivatives with high demand in personal care and food applications.

Factors Influencing Market Share:

Several factors influence market share in the PMED market:

-

Product Portfolio and Innovation: Companies with a diverse range of PMEDs and a strong focus on research and development (R&D) to create novel derivatives gain a competitive edge. -

Production Capacity and Efficiency: Consistent and high-volume production capabilities, along with efficient manufacturing processes, are crucial for market dominance. -

Sustainability Practices: Sustainable sourcing of palm oil and adherence to environmental regulations are increasingly important factors for brand reputation and market share. -

Cost Competitiveness: Offering competitive pricing while maintaining product quality allows players to attract a wider customer base. -

Geographical Reach: A strong global presence and established distribution networks enable companies to cater to diverse regional demands.

Key Companies in the Palm Methyl Ester Derivative market includes

- Musim Mas

- KLK Oleo

- Emery Oleochemicals Group

- Carotino Group

- Apical Group

- Asian Agri

- Ecogreen Oleochemicals

- Oleon NV

- VVF LLC

- Kao Corporation among others

Recent Developments

October 2023: Vantage Specialty Chemicals (US) announced the expansion of its sulfate-free surfactant and intermediate production facility in Germany. This expansion caters to the rising demand for natural personal care solutions utilizing PMEDs.

November 2023: KLK OLEO (Malaysia) signed a joint venture agreement with a major Chinese company to establish a new PMED production facility in China. This signifies the growing demand for PMEDs in the Asian market.

December 2023: The Roundtable on Sustainable Palm Oil (RSPO) implemented stricter certification standards for sustainable palm oil production. This could potentially impact the supply chain for some PMED manufacturers who may need to adjust their sourcing practices.

In December 2019 Indonesia released biodiesel that contains 30% palm oil, the highest-mandated blend in the world, in an effort to reduce its reliance on foreign oil and increase domestic palm oil use.

In hearing more recent news as of September 2023, KLK Oleo joined hands with P & G Chemicals with the specific intent of developing new formulations of palm methyl ester derivatives on personal care products. KLK wanted P&G’s capabilities in new product development, and the sourcing cyclopsed KLK’s potential.