Top Industry Leaders in the Packaged Water Treatment System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the industry are:

- Tonka Equipment Company (US)

- Corix Water System (Canada)

- Enviroquip (US)

- Napier Reid (Canada)

- Smith & Loveless Inc. (US)

- WestTech Engineering Inc. (US)

- RWL Water (US)

- Veolia Water Technologies (France)

- WPL Limited (UK)

- GE Water & Process Technologies (US), and others.

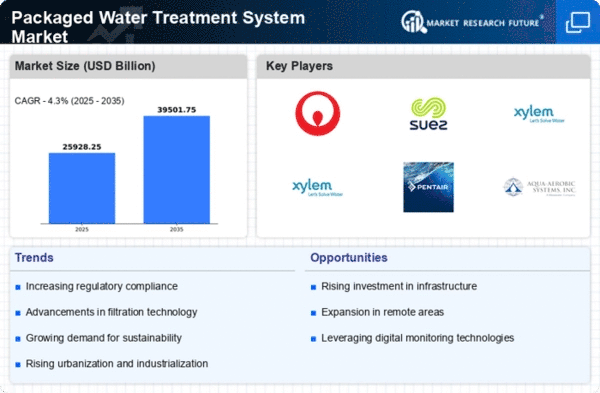

Purifying the Competition: Examining the Landscape of the Packaged Water Treatment System Market

The global packaged water treatment system market is a rapidly evolving arena where established players battle for a clean share of the pie. Understanding the diverse strategies that filter through the competition, the factors influencing market share, and emerging trends is crucial for navigating this dynamic market.

Key Players and their Strategies:

- Global Giants: Titans like Suez Water Technologies & Solutions and GE Water & Process Technologies leverage their extensive portfolios, global reach, and brand recognition to command a significant market share. Suez offers diverse packaged systems across industries, while GE excels in advanced membrane technologies like reverse osmosis.

- Regional Champions: Companies like Fluence and Veolia Water Technologies dominate specific geographies by tailoring solutions to regional regulations and water challenges. Fluence caters to decentralized water treatment needs in emerging markets, while Veolia excels in large-scale systems for municipalities and industries.

- Technology Trailblazers: Startups like BI Pure Water and RWL Water disrupt the market with innovative approaches. BI Pure Water focuses on compact, containerized systems for remote applications, while RWL specializes in sustainable solutions like wastewater reuse systems.

Factors for Market Share Analysis:

- Product Breadth and Depth: Offering a range of packaged systems for diverse applications (drinking water, wastewater, industrial) and capacities caters to varied customer needs and expands market reach.

- Technological Innovation: Integrating advanced technologies like membrane bioreactors, ultraviolet disinfection, and digital controls enhances treatment efficiency, water quality, and user experience. GE's advanced membrane systems illustrate this.

- Cost-Effectiveness and ROI: Balancing advanced features with affordability is crucial, especially in price-sensitive markets. Fluence's cost-effective containerized systems cater to this need.

- After-Sales Service and Support: Offering comprehensive after-sales support, including installation, maintenance, and spare parts, fosters customer loyalty and market penetration. Suez excels in this area with its global service network.

Emerging Trends and Company Strategies:

- Smart Systems: Integrating sensors, communication modules, and data analytics into packaged systems enables real-time performance monitoring, predictive maintenance, and remote management. BI Pure Water's cloud-connected systems exemplify this trend.

- Focus on Sustainability: Developing systems with low energy consumption, water reuse capabilities, and minimized waste generation is gaining traction. RWL's wastewater reuse systems cater to this growing demand.

- Modular and Scalable Solutions: Offering modular systems with easy expansion capabilities adapts to evolving water treatment needs and avoids over-investment. Fluence's modular containerized systems exemplify this approach.

- Focus on Decentralized Solutions: Targeting off-grid and remote areas with compact, self-contained packaged systems is a growing trend. BI Pure Water's containerized systems address this need.

Overall Competitive Scenario:

The packaged water treatment system market presents a dynamic landscape where global giants face challenges from regional specialists and technology-driven startups. Success hinges on offering diverse and technologically advanced systems, balancing affordability with innovation, prioritizing service and support, and adapting to emerging trends like smart technologies, sustainability, and modularity. Companies demonstrating agility, regional expertise, and a commitment to responsible water management hold a strong hand in filtering out the competition and securing a clear future in this evolving market.

Latest Company Updates:

November 2023

With the release of the eflow Tankless Reverse Osmosis System, EcoWater Systems is excited to transform the way that homes enjoy pure, delicious water. Beginning on November 1, 2023, this revolutionary product will only be sold through accredited EcoWater Dealerships.

Waiting for a water tank to fill is eliminated with eflow. Homeowners can take advantage of a constant supply of clean, fresh water for all of their cooking and drinking needs thanks to the continuous flow feature.

The small, tankless eflow design is ideal for homes of all sizes and fits neatly under sinks, even in confined spaces. By making effective use of available space, homeowners can optimize their countertop and storage areas. A notable characteristic of eflow is its dedication to environmental sustainability. Eflow users benefit from pure water and contribute to a cleaner environment by avoiding the need for bottled water.

Beginning on November 1, 2023, homeowners who would like to experience the eflow difference can get in touch with the closest authorized EcoWater dealership. The skilled installation by EcoWater's qualified specialists will guarantee a smooth transition to this cutting-edge system.

July 2023

The Pureit Revito Series of water purifiers has been introduced by Hindustan Unilever Limited (HUL). Up to 70% of the water is preserved by the water purifier, which also adds calcium and magnesium to the water after it has been cleaned.

With features like UV-in-tank sterilization and an enhanced external sediment filter that can remove up to 90% of turbidity, Pureit's Revito series offers an abundance of extra filtration capabilities.