Top Industry Leaders in the Outdoor Power Equipment Market

*Disclaimer: List of key companies in no particular order

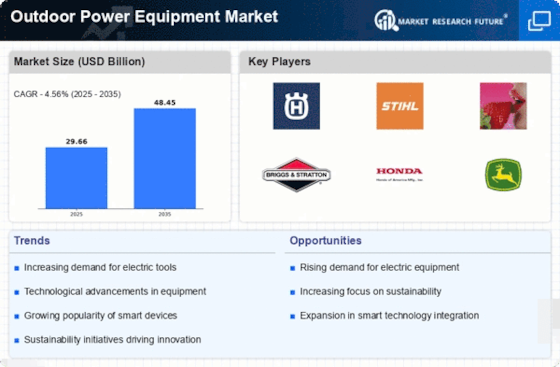

Top listed global companies in the industry are:

- Husqvarna (Sweden)

- Deere & Company (US.)

- Honda Motor Co., Ltd. (Japan)

- Blount International, Inc. (US.)

- The Toro Company (US.)

- STIHL Holding AG & Co. KG (Germany)

- Stanley Black & Decker Inc. (US.)

- Makita Corporation (Japan)

- MTD Products (US.)

- Emak S.p.A. (Italy)

- Techtronic Industries (Hong Kong), and others.

Cultivating Success: Navigating the Competitive Landscape of the Outdoor Power Equipment Market

The outdoor power equipment market hums with the sound of lawnmowers, trimmers, and chainsaws, fueled by homeowners, landscapers, and the relentless pursuit of manicured greenery. In this vibrant and diverse arena, established brands battle innovative upstarts, each vying for a slice of the fertile terrain.

Key Players and their Strategies:

- Industry Veterans: Briggs & Stratton, Cub Cadet, and John Deere leverage their extensive footprints, diverse product portfolios, and established dealer networks to maintain market leadership. John Deere, through its focus on premium lawnmowers and tractors, caters to discerning homeowners and professional landscapers.

- Regional Challengers: Companies like Honda and Husqvarna excel in specific geographies. Honda dominates the Asian market with its fuel-efficient engines and compact equipment, while Husqvarna thrives in Europe with its high-performance chainsaws and innovative robotic mowers.

- Technological Disruptors: Startups like Greenworks and Mowbi are shaking things up with cordless solutions and online-focused distribution. Greenworks, with its extensive line of cordless equipment, targets eco-conscious consumers, while Mowbi's direct-to-consumer model offers competitively priced robotic mowers.

Factors for Market Share Analysis:

- Product Breadth and Depth: Offering a comprehensive range of equipment for diverse outdoor tasks, from mowing and trimming to clearing and tilling, strengthens market position. Cub Cadet's diverse portfolio caters to various landscaping needs and price points.

- Technological Innovation: Companies at the forefront of cordless technology, battery advancements, robotics, and smart features like automated navigation and connectivity gain an edge. Deere's self-driving lawnmowers and Husqvarna's Automower robotic line exemplify this trend.

- Brand Reputation and Customer Loyalty: Building trust and brand recognition through quality products, reliable service, and excellent customer support is crucial for sustained success. Briggs & Stratton's reputation for durable engines and Husqvarna's focus on professional-grade equipment have built loyal customer bases.

- Affordability and Value Proposition: Balancing advanced features with cost-effectiveness and offering equipment tailored to specific user needs and budgets are key considerations. Greenworks' focus on affordable cordless tools resonates with eco-conscious DIYers, while Honda's fuel-efficient engines appeal to price-conscious homeowners.

Emerging Trends and Company Strategies:

- Cordless Revolution: The shift towards cordless equipment across all categories, driven by battery advancements and user convenience, is reshaping the market. Greenworks' extensive cordless line and Mowbi's focus on robotic mowers exemplify this trend.

- Sustainability Focus: Environmental concerns are driving demand for electric and battery-powered equipment, quieter operation, and energy-efficient technologies. Husqvarna's battery-powered chainsaws and John Deere's hybrid lawnmowers are at the forefront of this trend.

- Smart Features and Connectivity: Integrating sensors, Bluetooth connectivity, and app-based control features into equipment enables data tracking, performance optimization, and remote monitoring. Deere's JDLink telematics system and Husqvarna's Automower Connect app are prominent examples.

- Direct-to-Consumer and Online Distribution: Bypassing traditional retail channels and selling directly through online platforms is becoming increasingly popular, particularly for startups and cost-conscious brands. Mowbi's online sales model and Greenworks' strong online presence exemplify this.

Overall Competitive Scenario:

The outdoor power equipment market is a vibrant landscape where established brands grapple with tech-savvy startups and regional specialists. Success hinges on adapting to the cordless revolution, embracing sustainability, offering smart features and online options, and catering to specific user needs with the right balance of features and affordability. Understanding the competitive landscape and navigating its dynamic currents will be crucial for companies to cultivate a thriving future in this verdant market.

Latest Company Updates:

June 2023

John Deere, a world leader in cutting-edge and potent lawn equipment, and Chervon, the parent company of EGO and a major player in the Outdoor Power Equipment (OPE) and Power Tool industries, established a strategic partnership. Through John Deere dealers, the companies will be able to offer users EGO battery-powered lawn care options. Through the prestigious and extensive dealer network of John Deere, this partnership enhances the availability of EGO's award-winning line of battery-operated OPE by utilizing the capabilities of both businesses.

In accordance with this agreement, beginning in the autumn of 2023, John Deere dealers in the US and Canada will sell the whole line of EGO mowers, blowers, trimmers, edgers, chainsaws, and snow blowers. Through this partnership, customers will have quick access to EGO's innovative and high-performance products through John Deere's large network, which is renowned for its dedication to quality and customer care.

Customers will appreciate how easy it is to access EGO's battery-powered tools alongside John Deere's renowned array of outdoor and agricultural equipment.

February 2023

Makita, a pioneer in cordless technology, has announced the addition of 9 new items to the 40V | 80V max XGT System. The new products cover a wide range of industries and uses, such as outdoor power equipment, lighting, fastening, and concrete equipment.

The newest products are a part of the Makita XGT line of 40V and 80V max cordless tools and equipment. Users now have access to a single system that includes equipment-grade devices including high-capacity saws, rotary hammers, and power cutters that are all powered by 40V max XGT batteries.