Rising Incidence of Bone Fractures

The increasing prevalence of bone fractures, particularly among the aging population, appears to be a primary driver for the Osteosynthesis Implants Market. As individuals age, their bones become more susceptible to fractures due to decreased bone density and other health-related issues. According to recent statistics, the incidence of hip fractures alone is projected to rise significantly, leading to a heightened demand for osteosynthesis implants. This trend is further exacerbated by lifestyle factors such as increased participation in high-impact sports and accidents. Consequently, healthcare providers are likely to invest more in advanced osteosynthesis solutions to address these challenges, thereby propelling the growth of the Osteosynthesis Implants Market.

Increase in Sports-Related Injuries

The rise in sports-related injuries, particularly among younger populations, appears to be a significant factor driving the Osteosynthesis Implants Market. As participation in various sports continues to grow, the incidence of injuries requiring surgical intervention is also on the rise. Data indicates that sports injuries account for a considerable percentage of fractures, necessitating the use of osteosynthesis implants for effective treatment. This trend is likely to prompt healthcare systems to enhance their offerings in osteosynthesis solutions, thereby fostering growth in the market. The increasing awareness of sports safety and injury prevention may further contribute to the demand for advanced osteosynthesis implants.

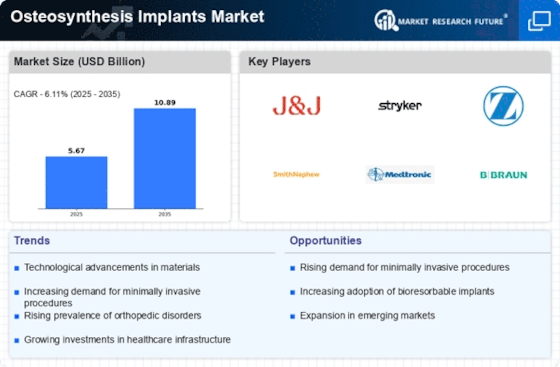

Technological Innovations in Implant Design

Technological advancements in the design and manufacturing of osteosynthesis implants are likely to play a crucial role in shaping the Osteosynthesis Implants Market. Innovations such as 3D printing and the use of biocompatible materials have led to the development of implants that are not only more effective but also tailored to individual patient needs. For instance, the introduction of smart implants equipped with sensors for real-time monitoring of healing processes could enhance patient outcomes. Market data suggests that the adoption of these advanced technologies is expected to increase, as healthcare providers seek to improve surgical results and reduce recovery times. This trend indicates a promising future for the Osteosynthesis Implants Market.

Aging Population and Increased Healthcare Expenditure

The aging population is a critical driver for the Osteosynthesis Implants Market, as older adults are more prone to fractures and other orthopedic conditions. This demographic shift is accompanied by increased healthcare expenditure, as governments and private sectors allocate more resources to address the needs of elderly patients. Market data suggests that healthcare spending on orthopedic procedures is expected to rise, reflecting the growing demand for osteosynthesis implants. As healthcare systems adapt to the needs of an aging population, the Osteosynthesis Implants Market is likely to experience robust growth, driven by the need for effective solutions to manage age-related bone health issues.

Growing Demand for Minimally Invasive Surgical Techniques

The shift towards minimally invasive surgical techniques is emerging as a significant driver for the Osteosynthesis Implants Market. These techniques offer numerous advantages, including reduced recovery times, less postoperative pain, and lower risk of complications. As surgeons increasingly adopt these methods, the demand for specialized osteosynthesis implants designed for minimally invasive procedures is likely to rise. Market analysis indicates that the minimally invasive surgery segment is expected to witness substantial growth, as patients and healthcare providers alike prioritize quicker recovery and improved surgical outcomes. This trend underscores the evolving landscape of the Osteosynthesis Implants Market.