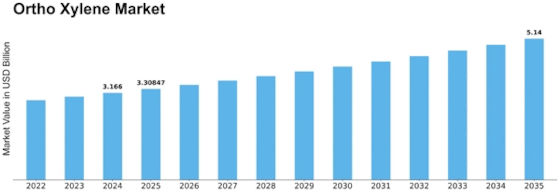

Ortho Xylene Size

Ortho Xylene Market Growth Projections and Opportunities

The Ortho-Xylene Market is influenced by various factors that collectively shape its growth and dynamics. A key driver is the demand from the petrochemical industry, where ortho-xylene serves as a vital raw material in the production of phthalic anhydride—a crucial component in the manufacturing of plasticizers. Plasticizers, in turn, find extensive use in the production of plastics, resins, and polymers, contributing to the demand for ortho-xylene. The growth of end-user industries such as construction, automotive, and packaging further propels the demand for ortho-xylene, reflecting its integral role in the production of various materials.

Geopolitical and economic factors significantly impact the Ortho-Xylene Market. As a petrochemical derivative, ortho-xylene is influenced by global oil prices, supply chain disruptions, and trade dynamics. Economic stability, currency exchange rates, and geopolitical events can affect the cost and availability of ortho-xylene, impacting the market conditions and influencing the purchasing decisions of end-users. The interconnectedness of the petrochemical industry with global economic conditions contributes to the market's sensitivity to external factors.

Technological advancements and innovations in production processes contribute to the dynamics of the Ortho-Xylene Market. Continuous research and development efforts focus on enhancing the efficiency and sustainability of ortho-xylene production. Innovations in catalyst technologies, feedstock selection, and process optimization aim to improve yield, reduce energy consumption, and minimize environmental impact. Technological advancements are critical in ensuring cost-effectiveness and environmental sustainability, driving the adoption of ortho-xylene in various industrial applications.

The demand from the construction, automotive, and packaging industries plays a pivotal role in driving the Ortho-Xylene Market. In the construction sector, ortho-xylene is utilized in the production of adhesives, coatings, and sealants, contributing to the durability and performance of construction materials. In the automotive industry, ortho-xylene is a key ingredient in the manufacturing of automotive coatings, enhancing the aesthetic appeal and corrosion resistance of vehicles. Additionally, ortho-xylene is used in the production of packaging materials, such as films and containers, further diversifying its applications across various end-use sectors.

Environmental considerations and regulatory standards are critical factors shaping the ortho-xylene market. The industry's commitment to sustainable practices aligns with stringent regulations governing the use, production, and disposal of chemicals. Compliance with environmental standards ensures that the production and use of ortho-xylene adhere to eco-friendly practices, making it suitable for applications where sustainability and regulatory compliance are priorities.

Market competition and industry collaborations are notable factors influencing the Ortho-Xylene Market. The market features a competitive landscape with key players continually innovating to gain a competitive edge. Collaboration within the industry supply chain, including partnerships between ortho-xylene producers, downstream manufacturers, and research institutions, contributes to the development of new formulations, applications, and industry standards. Partnerships also drive advancements in production efficiency, quality control, and safety measures.

Challenges related to feedstock availability, environmental impact, and volatility in oil prices are factors that the ortho-xylene industry addresses. Ortho-xylene is primarily produced as a byproduct in the reforming process of crude oil or naphtha. Feedstock availability and fluctuations in oil prices can impact the cost of ortho-xylene production. Additionally, the industry focuses on minimizing the environmental impact through the adoption of cleaner production processes and the development of eco-friendly alternatives to ortho-xylene in certain applications.

Leave a Comment