Market Trends

Key Emerging Trends in the Organic Chocolate Market

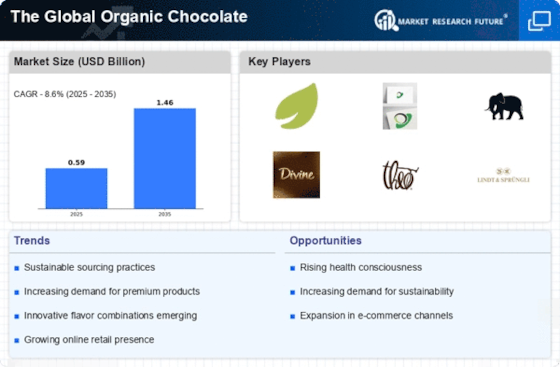

The Organic Chocolate Market landscape is determined by a host of factors, which collectively show the development of consumer tastes, attention to the environment, advances in technology and the actions of market participants to increase their competitiveness. Another factor of growth in this sector is the steep scaling up of the preferred products for the clear labels. Consumers now are tending to have transparency in their food choices. Eco-certified chocolate, which is based on natural and organic ingredients, certainly are consistent with this widening public preference. The call for natural and unprocessed options, free from chemicals and hormonal manipulation, boosts the sales of these organic chocolates and influences the way consumers behave and the approach undertaken by the manufacturers.

The dynamics of organic chocolate is is very affected by the technological innovations. The introduction of new or improved processing and production technologies helps producers improve the quality, taste, and sustainability of organic chocolate products. The involvement of technology varies from reducing the time needed for cocoa bean treatment to coming up with environmentally friendly packaging means, therefore, gives the playing field a new shape and forms the basis of production of organic chocolate. That statement pinpoints the essence of the industry which is characterised by embracing innovation as an approach to satisfy expectations of customers and stay successful in the digital markets that are ever-changing. Evaluation of both internal and external strengths and weaknesses is the most important component of the comprehensive assessment of the entire range of all potential opportunities. Additionally, as of this chapter, I would like to focus even more on the critical research on the market, which will once again emphasize the core role of growth. The study performs the analysis of the current state of the organic cocoa production in the market and reveals critical information about the development in the organic chocolate market which is certainly important for the market projections and forecasts in connection with older perspectives. Perhaps, the trend towards healthier eating is another opportunity the organic chocolate industry can benefit from. As people increasingly educate themselves on the foods that make them healthy and look out for healthier alternatives, organic chocolate starts to take the spotlight. These consumers, who are increasingly considering the impact that their food has on their health, are drawn to the availability of pesticides and the purchasing natural, organic ingredients. The social climate is largely reshaping the narrative on chocolate consumption by paying attention to the qualitative traits of organic chocolate that stand to make it a healthier option.

Visible market factor is that the eating preferences of the world's population experience a change. The sensitivity of the consumers to the fact of "green" source of food products and the increased interest in sustainable, ethical choices, affects consumers' choices. What is organic chocolate other than being sustainable and fair, champions these themes in the consumer market?

Leave a Comment