Optical Encoder Size

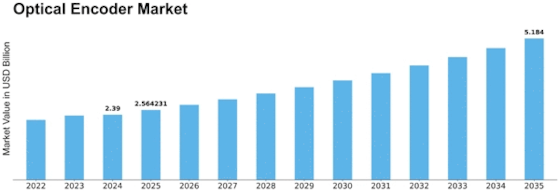

Optical Encoder Market Growth Projections and Opportunities

The optical encoder market is influenced by several key market factors that play a crucial role in shaping its dynamics. One of the primary drivers of this market is the increasing demand for high precision and accuracy in various industries. Optical encoders, with their ability to provide precise position and speed feedback, are essential components in applications such as robotics, medical devices, and manufacturing equipment. As industries strive for greater efficiency and performance, the demand for optical encoders continues to rise.

Another significant factor contributing to the growth of the optical encoder market is the expanding automation industry. As automation gains traction across various sectors, the need for accurate and reliable position sensing devices becomes paramount. Optical encoders find extensive usage in automated systems, ensuring precise control and feedback, which is critical for the seamless operation of automated machinery. This trend is expected to drive the market forward, especially in regions witnessing a surge in industrial automation.

Technological advancements also play a pivotal role in shaping the optical encoder market. Continuous innovations in encoder technology, such as the development of optical encoders with higher resolutions, improved durability, and enhanced communication capabilities, contribute to market growth. Manufacturers are investing in research and development to introduce cutting-edge solutions that cater to the evolving needs of different industries. As a result, end-users benefit from more reliable and efficient optical encoder systems, fostering market expansion.

Furthermore, the increasing adoption of optical encoders in the healthcare sector is influencing market dynamics. Medical devices often require precise motion control and positioning, and optical encoders provide the necessary accuracy for applications like diagnostic equipment, imaging devices, and robotic-assisted surgeries. The growing healthcare industry, coupled with the demand for advanced medical technologies, contributes significantly to the expansion of the optical encoder market.

Market factors are also shaped by the global emphasis on sustainability and energy efficiency. Optical encoders, being energy-efficient components, align with the broader push for green technologies. As industries strive to reduce their carbon footprint and enhance energy efficiency, the adoption of optical encoders becomes a strategic choice. This factor not only drives the market but also positions optical encoders as vital contributors to sustainable and environmentally friendly practices.

The competitive landscape and market dynamics are further influenced by the geographical distribution of key players and end-users. Regions with a strong presence of industries such as manufacturing, automotive, and electronics are likely to witness higher demand for optical encoders. Additionally, the emergence of new market players and the establishment of strategic partnerships contribute to the overall growth and competitiveness of the optical encoder market.

Leave a Comment