Operating Table Parts Size

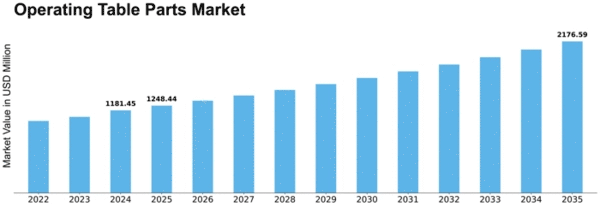

Operating Table Parts Market Growth Projections and Opportunities

The rising number of surgical methods worldwide is a vital driver for the operating table parts market. As healthcare foundation improves, and the predominance of continuous infections rises, there is a developing interest for cutting edge operating tables and their parts to help a different scope of medical procedures. The growing population adds to the development of the operating table parts market. Old people frequently require surgical interventions for age-related health issues, prompting an upsurge sought after for superior grade, adjustable operating table parts that take care of the necessities of more seasoned patients. The inclination for minimally invasive surgical methodology is a notable market factor. Operating table parts intended to work with negligibly obtrusive medical procedures, like those supporting mechanical helped strategies, are popular. Specialists progressively choose gear that empowers accuracy and decreases recuperation time, impacting market patterns. Patient and specialist security concerns drive the interest for mechanically progressed and ergonomically planned operating table parts. Elements like simple mobility, security, and disease control measures are basic contemplations, and healthcare offices focus on hardware that upgrades health during medical procedures. Interests in healthcare framework, especially in creating districts, add to the growth of the Operating Table Parts Market. New clinics and surgical centers furnished with present day offices require best in class operating tables and parts, encouraging market extension. The general rise in healthcare use universally is a critical market driver. With expanded monetary designations to healthcare, medical clinics and healthcare offices possess the ability to put resources into cutting edge operating table parts, supporting the market's persistent growth. The globalization of healthcare has prompted the development of operating table parts across borders. Market players participate in essential organizations, joint efforts, and dissemination arrangements to enter new markets and increment their worldwide impression, driving market elements.

Leave a Comment