Top Industry Leaders in the Oilseeds Market

Oilseeds Market Outlook

Oilseeds Market Outlook

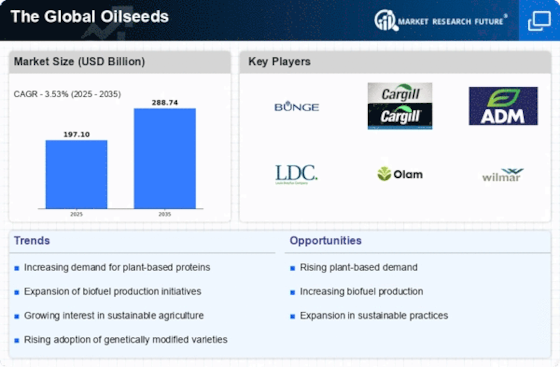

Oilseeds Market is marked by a competitive landscape shaped by key players adopting diverse strategies to secure their market positions. Among the prominent companies, Archer Daniels Midland Company, Bunge Limited, Cargill Incorporated, and Wilmar International Limited stand out as major contributors to the market's dynamics. These industry leaders have consistently implemented strategies such as mergers and acquisitions, partnerships, and expansions to strengthen their foothold.

Key Companies in the Oilseeds market include

- BASF SE (Germany)

- Monsanto Company (US)

- Groupe Limagrain Holding (France)

- Syngenta (Switzerland)

- DuPont (US)

- Nuziveedu Seeds Ltd (India)

- Land O'Lakes Inc. (US)

- Cargill

- Incorporated (US)

- Seed Co Limited (South Africa)

- Mahyco Seeds Company Limited (India)

Factors for Market Share Analysis:

Production Efficiency: Companies with efficient land utilization, optimized cultivation practices, and advanced processing technologies gain a competitive edge. Bunge's investments in precision agriculture tools and digital farming initiatives illustrate this focus.

Processing Prowess: Advanced oil extraction and refining capabilities enable companies to maximize yields and cater to diverse downstream applications. Louis Dreyfus Company's recent upgrade of its crushing facilities in Brazil showcases this emphasis on operational excellence.

Market Access & Distribution: Robust distribution networks and strong relationships with buyers in the food, biodiesel, and other industries secure market share. Wilmar International's extensive global trading network and strategic partnerships with food manufacturers exemplify this advantage.

New & Emerging Players:

Sustainability Champions: Start-ups like TerraVia and Benson Hill are entering the market with novel oilseed varieties boasting higher yields, lower environmental impact, and improved nutritional profiles. TerraVia's development of high-oleic algae oil is a prime example of this trend.

Vertical Integration Aspirants: Smaller companies are integrating backward into seed breeding and farming to secure stable supplies and control quality. This trend is exemplified by Beyond Meat's partnership with farmers to grow canola specifically for its plant-based protein production.

Industry News & Investment Trends:

Geopolitical Disruptions: The ongoing war in Ukraine has disrupted sunflower oil production and trade, pushing prices higher and prompting a shift towards alternative oils like soybean and canola. This volatility presents both challenges and opportunities for market players.

Sustainability Push: Growing consumer and regulatory pressure is driving investments in sustainable oilseed production practices, organic certification, and renewable energy derived from biodiesel. ADM's recent collaboration with a leading renewable energy company to produce biodiesel from soybean oil exemplifies this trend.

Emerging Markets Focus: Increased disposable incomes and urbanization in countries like China and India are driving demand for vegetable oils and animal feed, prompting companies to expand their presence in these markets. Cargill's joint venture with a Chinese feed producer highlights this strategic shift.

Competitive Scenario:

The oilseeds market is characterized by dynamic competition, with established giants facing challenges from regional players and innovative newcomers. Technological advancements, sustainability concerns, and geopolitical shifts are further shaping the landscape. Companies that adapt to these changing dynamics and invest in efficient operations, strategic partnerships, and innovative product offerings will be best positioned to capture market share and thrive in the years to come.

Oilseeds Market Industry Developments :

In September 2019, ASTON and Vandeputte Huilerie SA formed a joint venture to process linseed and produce oil within the borders of the Russian Federation.

October 2022: Bayer AG's seeds division was acquired by India-based agrochemical company Crystal Crop Protection Ltd for an undisclosed fee. The hybrid grain seeds included in this purchase include sorghum, cotton, mustard, and pearl millet. Crystal Crop aspires to be among the top seed companies with this acquisition. The purchase would also strengthen the field crop seed industry and make it a significant integrated Agri-Input player.