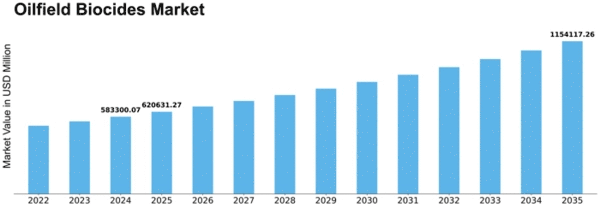

Oilfield Biocides Size

Oilfield Biocides Market Growth Projections and Opportunities

The oilfield biocides market is significantly influenced by various factors that shape its trends and growth trajectory. One of the primary drivers of this market is the increasing demand for oil and gas exploration and production activities worldwide. As the global population continues to grow and urbanize, there is a rising demand for energy, driving the need for more extensive exploration and extraction of oil and gas reserves. However, one of the challenges faced by the oil and gas industry is microbial contamination in oilfield operations, which can lead to corrosion, biofouling, and souring of oil and gas reservoirs. Oilfield biocides play a crucial role in controlling microbial growth and maintaining the integrity and efficiency of oilfield operations, driving market growth.

Technological advancements in biocide formulations and application techniques also significantly impact the oilfield biocides market. Manufacturers are continually innovating to develop biocides with improved efficacy, stability, and environmental compatibility. Advanced biocide formulations such as oxidizing biocides, non-oxidizing biocides, and microbiostatic agents are developed to address specific microbial challenges encountered in oilfield operations. Additionally, advancements in application techniques such as continuous injection systems, solid delivery systems, and microencapsulation technologies enhance the efficiency and longevity of biocide treatments, further fueling market demand.

Moreover, regulatory standards and environmental considerations play a vital role in shaping the oilfield biocides market dynamics. Regulatory bodies impose stringent regulations regarding the use and disposal of chemicals in oil and gas operations to ensure environmental protection and worker safety. Compliance with regulations such as EPA (Environmental Protection Agency) approval and OSHA (Occupational Safety and Health Administration) guidelines is essential for oilfield biocide manufacturers and operators to maintain regulatory compliance and meet industry standards. Additionally, growing environmental concerns about the impact of biocide usage on groundwater quality and ecosystem health drive the adoption of environmentally friendly and biodegradable biocide formulations, further influencing market dynamics.

The competitive landscape of the oilfield biocides market also impacts its growth trajectory. With numerous players competing for market share, competition is intense in terms of product quality, innovation, and pricing. Manufacturers invest in research and development to introduce new biocide formulations, improve production efficiency, and develop customized solutions tailored to meet specific customer needs. Strategic collaborations, partnerships, and acquisitions are common strategies employed by companies to expand their market presence and gain a competitive edge.

Furthermore, economic factors such as oil prices, drilling activity, and investment in oilfield infrastructure impact the oilfield biocides market. Fluctuations in oil prices affect the profitability of oilfield operations and the willingness of operators to invest in biocide treatments. Moreover, changes in drilling activity, such as increased shale exploration and offshore drilling, drive the demand for biocides to control microbial growth in challenging environments. Additionally, investment in oilfield infrastructure, such as pipelines, storage tanks, and well pads, drives the demand for biocides to protect assets from microbial degradation and corrosion, further fueling market growth.

Leave a Comment