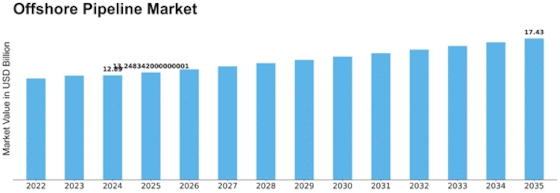

Offshore Pipeline Size

Offshore Pipeline Market Growth Projections and Opportunities

Technology is driving the offshore pipeline business. Continuous advances in pipeline design, materials, and construction procedures provide pipelines that can survive extreme offshore, deep-sea, and corrosive environments. Modern welding processes, high-strength metals, and corrosion prevention methods make offshore pipelines durable and efficient in transporting hydrocarbons over great distances.

Environment and government laws strongly impact the offshore pipeline sector. For offshore oil and gas safety and environmental responsibility, strict laws and requirements apply. These restrictions encourage the use of modern pipeline technology and safety measures, which promotes market demand for pipelines that meet strict industry requirements.

Economic factors, oil prices, and industry changes affect market dynamics. Oil price fluctuations affect offshore exploration and production investment choices and pipeline demand. Specialized pipeline systems that can transverse challenging underwater terrains and link remote wells to processing facilities are needed due to economic realities and industry developments like deeper offshore exploration and subsea tie-backs.

Offshore pipeline market dynamics depend on competition. Pipeline manufacturers, engineering firms, and service providers innovate and build high-performance pipeline systems due to intense competition. Companies distinguish their goods by delivering innovative features, better durability, and cost-effective solutions for offshore oil and gas operators. This competitive environment gives the sector alternatives and advances offshore pipeline technology.

Global energy demand and geopolitics affect offshore pipelines. Energy policy, geopolitical conflicts, and regional changes may affect offshore project investment and pipeline infrastructure demand. The geopolitical context shapes offshore exploration and production, affecting offshore pipeline market dynamics.

Environmental concerns and sustainability objectives influence market patterns. Sustainable offshore pipeline solutions are in demand as the sector confronts environmental scrutiny. Composite materials and pipeline monitoring technology are being used to improve offshore pipeline project environmental sustainability.

Market dynamics are also affected by oil and gas consumer preferences and awareness. Oil and gas companies want offshore pipeline systems that are technically superior, cost-effective, and adaptable to changing offshore circumstances. Manufacturers and service providers design pipeline technology that meet industrial needs, assuring offshore pipeline system dependability and efficiency.

In conclusion, global energy demand, technological advances, government regulations, economic conditions, industry trends, competitive dynamics, geopolitical factors, environmental concerns, and consumer preferences affect the offshore pipeline market. Offshore pipeline players must navigate this complicated terrain to adapt and succeed in a developing market that responds to offshore oil and gas sector problems and opportunities.

Leave a Comment