Market Share

Off-road Electric Vehicles Market Share Analysis

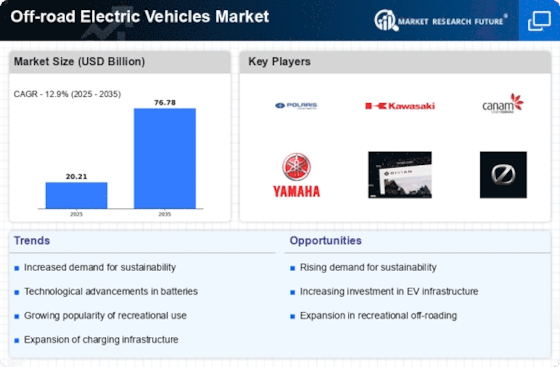

The market for off-road electric vehicles has experienced a big surge recently because of different trends that are changing the face of the off-road mobility. One main trend is the increasing demand for electric off-road vehicles across diverse applications such as agriculture, construction, recreational activities and military operations. This shift is driven by increased focus on sustainability, reduced emissions and clean energy alternatives’ adoption. In addition to being green compared to conventional petrol-run models this kind also tends to meet global environmental objectives by providing an efficient powerful off-road capability.

Progresses made in battery energy density as well as charging infrastructure has improved range extension and decreased charging times thus improving the feasibility and usability of these electrically powered cars across remote or rugged territories. Moreover, integration of smart technologies plus telematics systems into these automobiles allow for better performance monitoring, predictive maintenance and enhanced user experience thus boosting their uptake within various sectors.

Further still, electric off-road vehicles’ versatility and customization options are increasingly appealing to consumers. Manufacturers address different consumer requirements through provision of variety of vehicle types starting from all-terrain utility to high-performance off-road trucks and buggies. For instance modular designs plus interchangeable components are available that enhance adaptability of machines according to specific tasks or terrain conditions which makes them more versatile attractive across multiple applications.

Also, safety and regulatory compliance have emerged as key issues in the off-highway EV market space. These car operate in rugged conditions that require strong safety features besides full compliance with industry’s standards Manufacturers incorporate advanced safety features including stability controls rollover protections impact resistant designs among others so as to improve user safety while meeting necessary regulations. By adhering to safety standards not only would consumer confidence be built but also it enables broadening of the potential applications in various industries and hence leading to market growth.

Trends such as sustainability, technological advancements, customization options, safety enhancements and recreational adoption have been identified as driving forces behind the remarkable growth and transformation being witnessed in the market of off-road EVs. These trends would redefine the landscape of off-highway mobility by offering both customers and industry an attractive option away from conventional gas-fueled off-road autos. As technology continues to evolve with consumers’ demands for ecological friendly versatile off-roaders persisting therefore prospects for further expansions diversification and innovations into the future remain high in this market of EVs for rough terrains.

Leave a Comment