Off Grid Solar Size

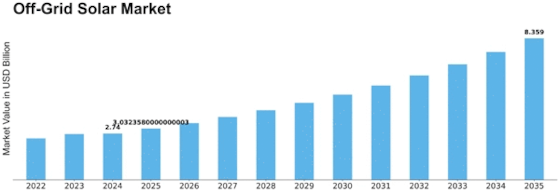

Off-Grid Solar Market Growth Projections and Opportunities

The Off-Grid Solar market is influenced by various market factors that play a pivotal role in shaping its dynamics. One of the primary drivers is the increasing demand for reliable and sustainable energy solutions in remote and rural areas where traditional grid infrastructure is often inaccessible. Off-Grid Solar systems provide a viable alternative, offering a decentralized and independent power source. This rising demand is further fueled by the growing awareness of the environmental impact of conventional energy sources, prompting consumers to seek cleaner and renewable alternatives.

Government policies and incentives also significantly impact the Off-Grid Solar market. Many governments around the world are implementing favorable policies to promote the adoption of renewable energy solutions, including tax credits, subsidies, and regulatory support. These incentives not only make Off-Grid Solar systems more affordable for end-users but also create a conducive environment for industry growth. Additionally, initiatives aimed at electrifying remote areas contribute to the market expansion, as Off-Grid Solar is often the most practical and cost-effective solution in such scenarios.

Technological advancements play a crucial role in shaping the Off-Grid Solar market landscape. Continuous innovations in solar panel efficiency, battery storage technology, and power electronics contribute to the improvement of Off-Grid Solar systems' performance and reliability. As these technologies evolve, the overall cost of Off-Grid Solar solutions tends to decrease, making them more attractive to a broader consumer base. Integration of smart technologies, such as remote monitoring and control, further enhances the efficiency and usability of Off-Grid Solar systems.

Economic factors also influence the Off-Grid Solar market, with the total cost of ownership being a critical consideration for consumers. As the cost of solar panels, batteries, and associated components decreases, the return on investment for Off-Grid Solar systems becomes more favorable. Additionally, the long-term cost savings offered by Off-Grid Solar, compared to reliance on traditional energy sources, make it an economically viable option for consumers seeking sustainable and cost-effective energy solutions.

Market competition and industry collaborations contribute to the overall development of the Off-Grid Solar sector. The presence of multiple players in the market fosters innovation and drives manufacturers to enhance the quality and features of their products. Collaborations between Off-Grid Solar companies and other stakeholders, such as NGOs and local governments, facilitate the implementation of large-scale projects in underserved regions. These collaborations help address not only energy needs but also contribute to social and economic development in these areas.

Environmental concerns are increasingly shaping consumer preferences and driving the Off-Grid Solar market. The desire to reduce carbon footprints and minimize environmental impact prompts individuals and businesses to choose renewable energy options. Off-Grid Solar systems, being inherently clean and sustainable, align with this growing environmental consciousness, making them a preferred choice for those seeking greener energy alternatives.

The Off-Grid Solar market is influenced by a combination of factors, including increasing demand for reliable energy in remote areas, supportive government policies, technological advancements, economic considerations, market competition, industry collaborations, and environmental awareness. These factors collectively contribute to the growth and evolution of the Off-Grid Solar market, as it continues to emerge as a key player in the global renewable energy landscape.

Leave a Comment