Market Trends

Key Emerging Trends in the OEM Insulation Market

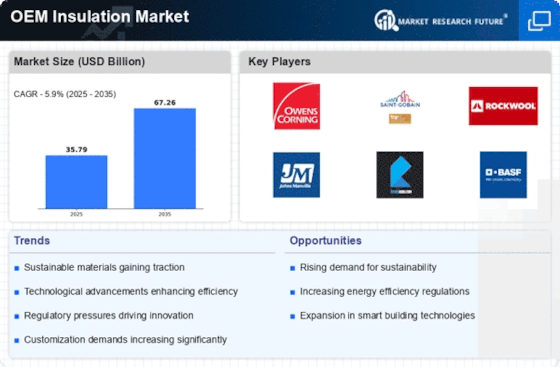

OEM Insulation Market trends are driven by energy efficiency measures, strict building requirements, and the expansion of sectors requiring specialist insulation solutions. OEM insulation includes materials and products incorporated into original equipment during production. Industry need for energy-efficient technologies, notably automobiles and appliances, is rising. OEMs are using sophisticated insulation materials to improve energy efficiency, decrease emissions, and meet regulatory criteria as worldwide awareness of energy saving and environmental sustainability grows. This trend supports industry-wide sustainability goals.

OEM insulation is also growing due to electric car use. As the automobile industry shifts toward electric mobility, OEMs are using insulating materials to regulate thermal characteristics, increase battery performance, and boost energy economy. Insulation helps EVs succeed by solving temperature issues with electric drivetrains and batteries.

Material and manufacturing advancements also affect OEM insulation sales. Manufacturers are developing insulating materials with improved lightweight, fire resistance, and OEM compatibility. Insulation systems with thermal management and temperature detection are also being developed using smart and linked technology. This trend follows material science advances to fulfill OEM needs.

The construction and building industries is also driving OEM insulation demand. HVAC systems, appliances, and building components use OEM insulation to increase energy efficiency and thermal comfort. Construction OEMs want insulating solutions that boost energy efficiency as building rules tighten and energy performance criteria rise. This trend reflects attempts to design energy-efficient, sustainable buildings.

OEM insulation industry trends are shaped by government energy efficiency, emissions reduction, and product safety laws. Standards are being implemented worldwide to promote energy-efficient production, minimize greenhouse gas emissions, and improve product thermal performance. OEMs must comply with these rules to fulfill market expectations, ensure product safety, and promote responsible and sustainable insulating material usage.

However, cost, competition from other materials, and personalization are issues. Cost can limit high-performance insulating material use, especially in price-sensitive OEM applications. Insulation performance and cost-effectiveness must be balanced to solve this problem. Aerogels and sophisticated composite materials challenge OEM insulation manufacturers, requiring constant innovation and distinction. Insulation producers must be flexible to fulfill varied industry needs for OEM customization and production processes.

Leave a Comment