Regulatory Support and Standardization

Regulatory support and standardization are pivotal in shaping the Nucleic Acid Amplification Testing Market. Governments and health organizations are increasingly recognizing the importance of establishing clear guidelines for the use of nucleic acid tests. This regulatory framework not only ensures the safety and efficacy of testing methods but also fosters public trust in diagnostic technologies. As regulatory bodies streamline approval processes for new tests, the market is likely to experience accelerated growth. Moreover, standardization efforts contribute to the comparability of test results across different laboratories, enhancing the overall reliability of nucleic acid amplification tests. This supportive regulatory environment suggests a favorable outlook for the Nucleic Acid Amplification Testing Market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the Nucleic Acid Amplification Testing Market. As healthcare moves towards tailored treatment plans based on individual genetic profiles, the need for precise diagnostic tools becomes paramount. Nucleic acid amplification tests facilitate the identification of specific genetic markers, enabling healthcare providers to customize therapies for patients. This trend is supported by an increasing number of clinical trials focusing on genetic testing, which is projected to drive market growth. The integration of these tests into routine clinical practice is likely to enhance patient outcomes and optimize resource allocation in healthcare systems. Consequently, the Nucleic Acid Amplification Testing Market is poised for expansion as it aligns with the evolving landscape of personalized healthcare.

Rising Prevalence of Infectious Diseases

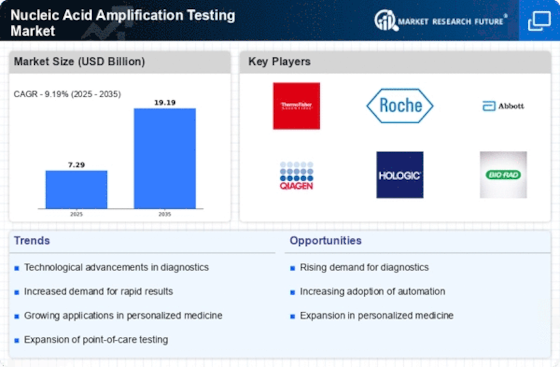

The increasing incidence of infectious diseases is a primary driver for the Nucleic Acid Amplification Testing Market. As pathogens evolve and new strains emerge, the demand for rapid and accurate diagnostic tools intensifies. For instance, the World Health Organization has reported a rise in cases of diseases such as tuberculosis and hepatitis, necessitating advanced testing methods. Nucleic acid amplification tests provide high sensitivity and specificity, making them essential in clinical settings. The market is projected to grow as healthcare providers seek efficient solutions to manage outbreaks and ensure timely treatment. This trend indicates a robust future for the Nucleic Acid Amplification Testing Market, as it aligns with the urgent need for effective disease management strategies.

Technological Innovations in Testing Methods

Technological advancements play a crucial role in shaping the Nucleic Acid Amplification Testing Market. Innovations such as real-time PCR and next-generation sequencing have revolutionized the way nucleic acids are amplified and analyzed. These technologies enhance the speed and accuracy of diagnostics, allowing for quicker decision-making in clinical environments. The market is witnessing a surge in the adoption of automated systems that streamline testing processes, thereby reducing human error and increasing throughput. According to recent data, the market for automated nucleic acid amplification systems is expected to expand significantly, driven by the need for efficiency in laboratories. This evolution in technology suggests a promising trajectory for the Nucleic Acid Amplification Testing Market.

Increased Investment in Research and Development

Investment in research and development is a significant catalyst for the Nucleic Acid Amplification Testing Market. As stakeholders recognize the potential of nucleic acid tests in various applications, funding for innovative research is on the rise. This influx of capital supports the development of novel testing methodologies and enhances existing technologies. Furthermore, collaborations between academic institutions and industry players are fostering advancements in nucleic acid amplification techniques. The market is expected to benefit from these initiatives, as they lead to the introduction of more efficient and cost-effective testing solutions. This trend indicates a vibrant future for the Nucleic Acid Amplification Testing Market, driven by continuous innovation and improvement.