Top Industry Leaders in the North America Speed Sensor Market

The Competitive Landscape of the North America Speed Sensor Market

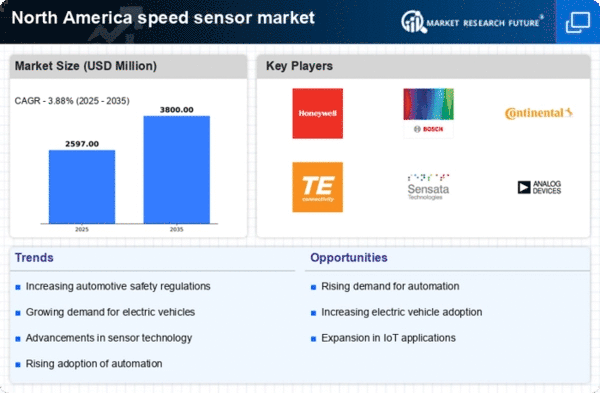

The North American speed sensor market, fueled by rising automation, stringent emission regulations, and the burgeoning electric vehicle (EV) market. This dynamic landscape, characterized by established players and innovative newcomers, presents a complex and competitive environment.

Key Players:

- Rockwell Automation, Inc.

- ABB

- NXP Semiconductors

- STMicroelectronics

- Infineon Technologies AG

- Schneider Electric

- Smith Systems, Inc.

- HYDAC Technology Corporation

- Micro-Epsilon

- Texas Instruments Incorporated

- Continental AG

- Bosch Engineering

- Motion Sensors, Inc.

- Rechner Sensors

- Honeywell International Inc.

Strategies Adopted by Leaders

- Product Portfolio Diversification: They offer a diverse range of speed sensors catering to various applications across automotive, industrial, and aerospace sectors, addressing diverse needs.

- Technological Innovation: Continuous R&D investment leads to advancements in sensor accuracy, reliability, miniaturization, and integration with advanced communication protocols.

- Strategic Partnerships and Acquisitions: Collaborations with technology providers and OEMs expand reach, access new markets, and accelerate technology adoption.

- Focus on Industry-Specific Solutions: Tailored solutions for specific industries like automotive ABS systems or industrial process monitoring cater to unique requirements.

Factors for Market Share Analysis:

- Breadth of Product Portfolio: Companies offering a wider range of sensor types, functionalities, and price points attract a broader customer base.

- Technological Innovation and Features: Advanced features like high-precision sensing, wide operating temperature ranges, and resistance to harsh environments create an edge.

- Brand Reputation and Service: Established brands with a strong reputation for quality, reliability, and after-sales support command customer loyalty.

- Cost-Effectiveness and Value Proposition: Balancing competitive pricing with high-quality offerings that deliver clear value is essential for market penetration.

- Compliance with Industry Standards: Adherence to relevant industry standards like SAE and ISO ensures compatibility and facilitates wider adoption.

New and Emerging Companies:

- Niche Market Focus: Targeting specific segments like micro-sized sensors for drones or high-performance sensors for racing applications offers differentiation.

- Cost-Effective Approaches: Utilizing innovative designs or low-cost materials allows them to compete on price, attracting budget-sensitive customers.

- Agile Development and Customization: Smaller companies adapt quickly to market trends and offer customized solutions, catering to specific customer needs.

- Focus on Emerging Technologies: Integrating with AI and IoT platforms for data analysis and predictive maintenance offers advanced functionalities.

- Strategic Partnerships: Collaborations with established players or technology providers enable them to access resources and expertise, accelerating growth.

Industry Developments:

Bosch:

- January 10, 2024: Announced a collaboration with HERE Technologies to develop new location-based speed sensor solutions for ADAS systems.

- November 22, 2023: Launched a new line of miniaturized speed sensors for industrial applications.

Continental:

- February 15, 2024: Unveiled a new LiDAR-based speed sensor for autonomous vehicles with centimeter-level accuracy.

- December 12, 2023: Partnered with NXP Semiconductors to develop AI-powered speed sensors for connected car applications.

TE Connectivity:

- February 2, 2024: Announced the acquisition of Measurement Specialties, Inc., a leading provider of sensor technologies.

- October 26, 2023: Launched a new series of wireless speed sensors for remote monitoring applications.