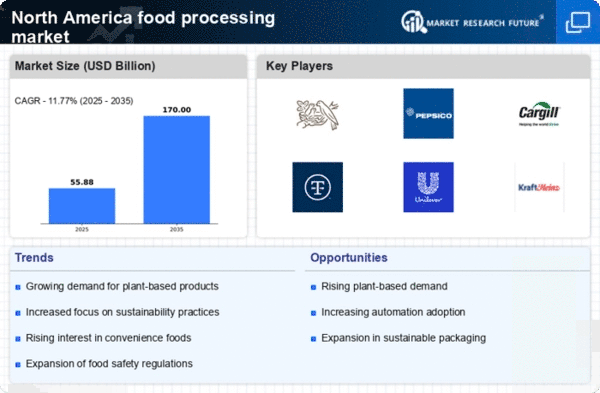

Growth of Plant-Based Alternatives

The food processing market in North America is witnessing a significant shift towards plant-based alternatives. This trend is driven by increasing health awareness and a growing number of consumers adopting vegetarian and vegan diets. Market Research Future indicates that the plant-based food sector is projected to reach $74 billion by 2027, highlighting the potential for growth within the food processing market. Companies are responding by diversifying their product offerings to include plant-based proteins and dairy alternatives. This shift not only caters to health-conscious consumers but also aligns with sustainability goals, as plant-based diets are often associated with lower environmental impact. As a result, the food processing market is likely to see increased competition and innovation in this segment.

Rising Demand for Convenience Foods

The food processing market in North America experiences a notable surge in demand for convenience foods. Busy lifestyles and changing consumer preferences drive this trend, as individuals seek quick and easy meal solutions. According to recent data, the convenience food segment is projected to grow at a CAGR of approximately 4.5% through 2027. This growth is indicative of a broader shift towards ready-to-eat and pre-packaged meals, which are increasingly favored by consumers. The food processing market must adapt to these evolving preferences by innovating and expanding product lines that cater to convenience without compromising quality. As a result, manufacturers are likely to invest in advanced processing techniques to enhance product shelf life and nutritional value, thereby meeting consumer expectations.

Increased Focus on Food Safety Standards

Food safety remains a paramount concern within the food processing market in North America. Regulatory bodies enforce stringent safety standards to ensure consumer protection, which has led to increased investments in quality control measures. The food processing market is adapting by implementing advanced technologies such as blockchain for traceability and monitoring. Recent statistics indicate that the food safety market is expected to reach $20 billion by 2026, reflecting the industry's commitment to maintaining high safety standards. This focus on food safety not only protects consumers but also enhances brand reputation, as companies that prioritize safety are likely to gain consumer trust and loyalty. Consequently, the food processing market is compelled to continuously innovate and comply with evolving regulations.

Technological Advancements in Processing Techniques

Technological advancements play a crucial role in shaping the food processing market in North America. Innovations such as automation, artificial intelligence, and machine learning are transforming production processes, enhancing efficiency and reducing costs. The food processing market is increasingly adopting these technologies to streamline operations and improve product quality. For instance, the integration of AI in quality control processes allows for real-time monitoring and adjustments, ensuring consistent product standards. Recent estimates suggest that the adoption of automation in food processing could lead to a 20% reduction in operational costs by 2028. This technological evolution not only boosts productivity but also enables companies to respond swiftly to changing consumer demands, thereby maintaining competitiveness in the market.

Evolving Consumer Preferences for Clean Label Products

The food processing market in North America is experiencing a shift towards clean label products, as consumers become more discerning about ingredient transparency. This trend reflects a growing demand for products with minimal processing and recognizable ingredients. Recent surveys indicate that approximately 60% of consumers prefer clean label options, prompting the food processing market to reformulate existing products and develop new offerings. Companies are increasingly focusing on natural ingredients and avoiding artificial additives, which aligns with consumer desires for healthier options. This shift not only enhances brand loyalty but also positions companies favorably in a competitive landscape. As a result, the food processing market is likely to invest in research and development to meet these evolving consumer expectations.