Rising Demand for Plant-Based Proteins

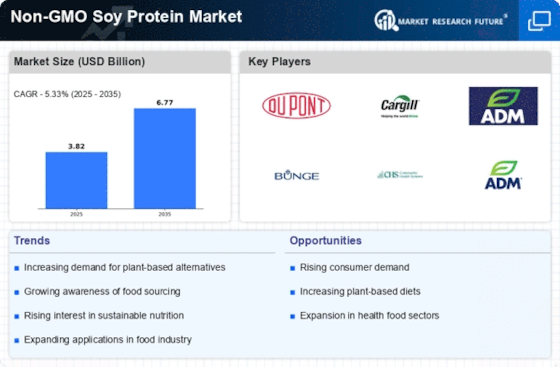

The Non-GMO Soy Protein Market is experiencing a notable surge in demand for plant-based proteins, driven by a growing consumer preference for healthier dietary options. As individuals increasingly seek alternatives to animal-based proteins, the market for non-GMO soy protein is expanding. According to recent data, the plant-based protein sector is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend is indicative of a broader shift towards vegetarian and vegan diets, which are perceived as healthier and more sustainable. Consequently, manufacturers are responding by innovating and diversifying their product offerings to cater to this evolving consumer base, thereby enhancing their market presence in the Non-GMO Soy Protein Market.

Increased Awareness of Non-GMO Products

Consumer awareness regarding the benefits of non-GMO products is on the rise, significantly impacting the Non-GMO Soy Protein Market. As more individuals become informed about the potential health risks associated with genetically modified organisms, they are gravitating towards non-GMO alternatives. This shift is reflected in market data, which indicates that sales of non-GMO food products have increased by over 20% in recent years. Retailers are also adapting to this trend by expanding their non-GMO product lines, thereby creating a more favorable environment for non-GMO soy protein. This heightened awareness not only drives demand but also encourages manufacturers to ensure transparency in their sourcing and production processes, further solidifying the market's growth trajectory.

Regulatory Support for Non-GMO Labeling

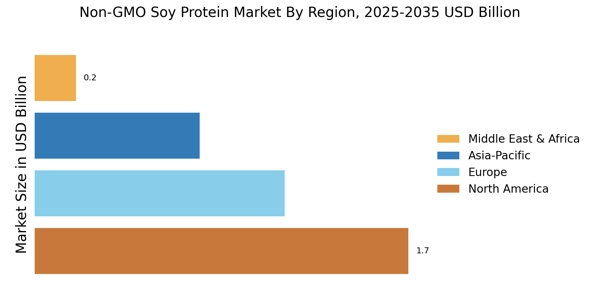

The Non-GMO Soy Protein Market benefits from increasing regulatory support for non-GMO labeling, which enhances consumer trust and market credibility. Governments in various regions are implementing stricter regulations regarding the labeling of genetically modified foods, thereby promoting transparency and informed consumer choices. This regulatory environment is conducive to the growth of the non-GMO sector, as it encourages manufacturers to adopt non-GMO practices. Market data suggests that regions with stringent labeling laws have seen a corresponding increase in non-GMO product sales, indicating a direct correlation between regulation and market growth. As consumers become more discerning, the presence of clear labeling will likely bolster the demand for non-GMO soy protein, further propelling the industry forward.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are increasingly influencing consumer purchasing decisions, thereby impacting the Non-GMO Soy Protein Market. As awareness of environmental issues grows, consumers are more inclined to choose products that align with their values, particularly those that are sustainably sourced. Non-GMO soy protein is often perceived as a more environmentally friendly option compared to conventional soy protein, which may involve harmful agricultural practices. Market trends indicate that products marketed as sustainable are witnessing higher sales, with consumers willing to pay a premium for such options. This shift towards sustainability not only drives demand for non-GMO soy protein but also encourages manufacturers to adopt eco-friendly practices, thereby enhancing their competitive edge in the market.

Innovation in Food Products and Applications

Innovation in food products and applications is a key driver for the Non-GMO Soy Protein Market, as manufacturers continuously seek to develop new and appealing offerings. The versatility of non-GMO soy protein allows it to be incorporated into a wide range of food products, from meat alternatives to protein bars and beverages. Recent market analysis indicates that the introduction of innovative non-GMO soy protein products has led to a significant increase in consumer interest and sales. This trend is likely to continue as companies invest in research and development to create unique formulations that cater to diverse dietary preferences. As a result, the Non-GMO Soy Protein Market is poised for sustained growth, driven by ongoing innovation and product diversification.