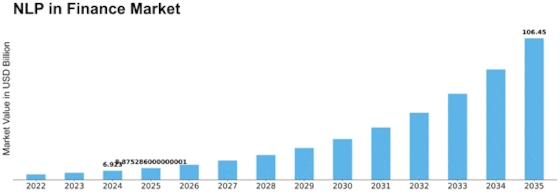

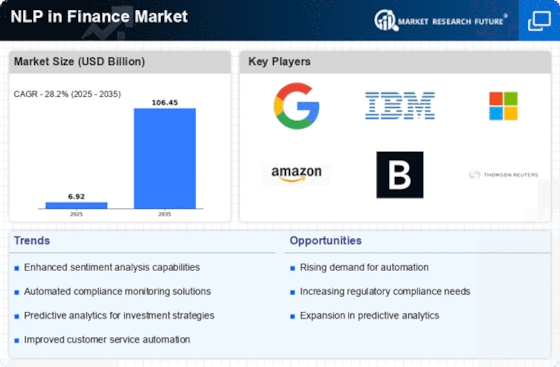

Nlp In Finance Size

NLP in Finance Market Growth Projections and Opportunities

The Next Generation Data Storage Technologies market is undergoing significant transformations driven by various market factors. One key factor influencing this sector is the exponential growth of data generated globally. As businesses and individuals continue to produce vast amounts of data, the demand for advanced data storage solutions is escalating. This surge is propelled by the proliferation of digital technologies, the Internet of Things (IoT), and the increasing adoption of artificial intelligence, which collectively contribute to the massive data influx.

Another crucial market factor shaping the landscape of next-generation data storage technologies is the ever-evolving technological landscape. Innovations in storage mediums, such as non-volatile memory technologies like NAND flash and emerging technologies like 3D XPoint, are driving the development of faster, more reliable, and energy-efficient storage solutions. These advancements not only enhance storage performance but also contribute to the overall efficiency of data processing systems.

The rising importance of data security and privacy is yet another factor steering the Next Generation Data Storage Technologies market. With the growing awareness of cybersecurity threats and the increasing value of sensitive data, organizations are seeking storage solutions that offer robust security features. The integration of encryption, access controls, and secure data erasure mechanisms is becoming essential to safeguard data integrity and confidentiality, influencing the market dynamics significantly.

Cost considerations play a pivotal role in the adoption of next-generation data storage technologies. While there is a continuous demand for high-capacity storage solutions, organizations are also looking for cost-effective options. The market is witnessing a shift towards more economical and scalable storage solutions that provide a balance between performance and affordability. This has led to the emergence of cloud-based storage services and software-defined storage solutions, offering flexibility and cost efficiency.

Interconnectivity and compatibility are additional market factors that cannot be overlooked. As data storage becomes more distributed and organizations operate in hybrid or multi-cloud environments, seamless integration between storage systems and interoperability with various platforms become imperative. The market is responding with solutions that prioritize compatibility, enabling organizations to manage and access their data seamlessly across diverse infrastructures.

Leave a Comment