Nickel Hydroxide Size

Nickel Hydroxide Market Growth Projections and Opportunities

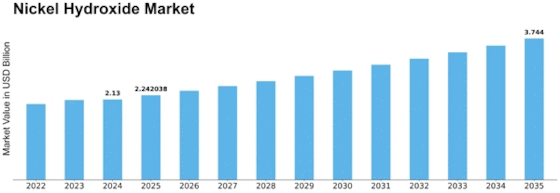

The global nickel hydroxide market is poised for substantial growth, anticipated to showcase a Compound Annual Growth Rate (CAGR) of 6.13%, ultimately reaching an estimated value of USD 2,595,749.1 thousand by the conclusion of the forecast period. In terms of volume, the global market, currently measured at 259,939.3 tons, is projected to expand to 389,315.4 tons, manifesting a CAGR of 4.705 throughout the assessment period. The primary catalyst behind this notable growth is the burgeoning electric vehicle (EV) sector, driven by increasing environmental awareness. Nickel hydroxide has emerged as a prevalent battery material for EVs, offering distinct advantages over conventional nickel-cadmium (Ni-Cd) batteries. These advantages include a 30–40% larger capacity, ease of storage and transportation, environmental friendliness, and recyclability. The escalating demand for electric vehicles on a global scale has, consequently, propelled the demand for nickel hydroxide.

Another contributing factor to the market's expansion is the rapid growth within the consumer electronics goods category. Nickel hydroxide finds extensive use in electroplating various electronic components, such as printed circuit boards (PCBs), connections, and microprocessors, further bolstering its market demand.

However, a notable challenge to market growth stems from the adverse health effects associated with exposure to and inhalation of nickel hydroxide, presenting a potential constraint throughout the assessment period.

Despite these challenges, an encouraging factor for market participants lies in the increased investment by multiple entities in the EV industry. This focus is particularly evident in initiatives involving tax breaks, subsidies, and the overall electrification of transportation. Such investments are poised to create new development opportunities within the nickel hydroxide market.

Analyzing the market based on application, end-use, and region, the segmentation reveals insightful trends. In terms of application, the market is categorized into batteries, catalysts, and others. The batteries segment stands out as the leading and fastest-growing category, with a value of USD 1,229,189.41 thousand in 2021. The remarkable growth of this segment is attributed to the escalating demand for EVs driven by environmental concerns and governmental policies.

Examining end-use, the market is segmented into automotive, electronics, chemical, and others. The automotive segment claims the largest market share in 2021 and is projected to reach a value of USD 2,078,418.06 thousand by the forecast period's conclusion. The significant growth in the electric vehicle sector, coupled with the widespread adoption of Internet of Things (IoT) and Big Data in automobiles, is anticipated to fuel the demand for nickel hydroxide within the automotive segment.

Regionally, the market spans across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific region is anticipated to exhibit the fastest growth, driven by China's dominance in automobile sales. The Chinese government has implemented legislative changes with the goal of achieving increased electric car usage by 2040. Manufacturers are now obligated to make substantial progress toward the target of having electric vehicles constitute 40% of all sales by 2040. Consequently, nickel hydroxide batteries are expected to become the preferred choice for battery production in this evolving landscape.

Leave a Comment