North America : Innovation and Leadership Hub

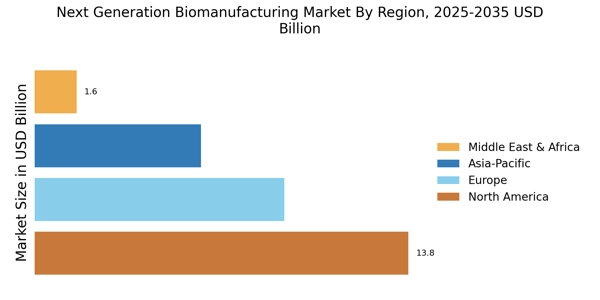

North America dominated the global Next-Generation Biomanufacturing Market in 2024, reaching a market size of USD 13.8 Billion. The region benefits from robust investment in biotechnology, advanced research facilities, and a strong regulatory framework that encourages innovation. The increasing demand for biologics and personalized medicine is driving growth, supported by government initiatives aimed at enhancing biomanufacturing capabilities.

The United States leads the market, with significant contributions from companies like Amgen and Genentech. Canada is also emerging as a key player, focusing on sustainable biomanufacturing practices. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for a share in this rapidly evolving sector. The presence of major players ensures a dynamic market environment, fostering collaboration and technological advancements.

Europe : Regulatory Framework and Growth

Europe is the second largest market for next generation biomanufacturing, accounting for approximately 30% of the global market share. The region's growth is driven by stringent regulatory standards that promote high-quality production processes and a strong emphasis on sustainability. European governments are investing in biomanufacturing initiatives, aiming to enhance competitiveness and innovation in the sector.

Germany and Switzerland are leading countries in this market, with significant contributions from companies like Bayer and Novartis. The competitive landscape is marked by collaboration between academia and industry, fostering innovation. The presence of key players and a supportive regulatory environment position Europe as a vital hub for biomanufacturing advancements. The European Medicines Agency continues to play a crucial role in ensuring compliance and safety in biomanufacturing practices.

Asia-Pacific : Rapid Growth and Investment

Asia-Pacific is witnessing rapid growth in the next generation biomanufacturing market, holding approximately 20% of the global market share. The region's expansion is fueled by increasing investments in biotechnology, a growing population, and rising healthcare demands. Countries like China and India are focusing on enhancing their biomanufacturing capabilities, supported by government policies aimed at boosting the sector.

China is the largest market in the region, with significant investments from both domestic and international companies. India is also emerging as a key player, leveraging its skilled workforce and cost-effective production capabilities. The competitive landscape is evolving, with a mix of established firms and startups driving innovation. The presence of major global players is further enhancing the region's biomanufacturing landscape, making it a focal point for future growth.

Middle East and Africa : Emerging Opportunities and Challenges

The Middle East and Africa region is gradually developing its next generation biomanufacturing market, currently holding about 5% of the global market share. The growth is driven by increasing healthcare needs, government initiatives to promote biotechnology, and investments in research and development. However, challenges such as regulatory hurdles and infrastructure limitations remain significant barriers to rapid growth.

Countries like South Africa and the UAE are taking steps to enhance their biomanufacturing capabilities, with a focus on local production to meet healthcare demands. The competitive landscape is still in its infancy, with a few key players beginning to establish a foothold. As the region continues to invest in biotechnology, it is poised for gradual growth, with potential for significant advancements in the coming years.