Advancements in Synthetic Biology

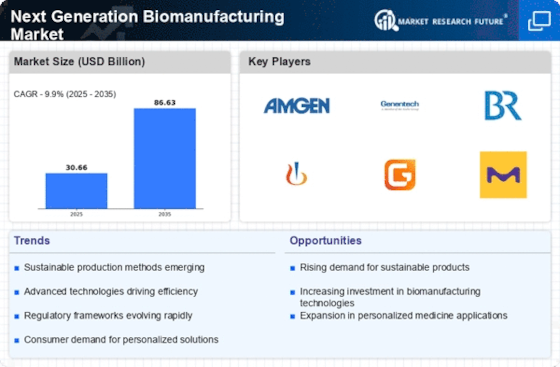

Advancements in synthetic biology are significantly influencing the Next Generation Biomanufacturing Market. This field combines biology and engineering to design and construct new biological parts, devices, and systems. The ability to manipulate genetic material allows for the creation of microorganisms that can produce valuable compounds, such as biofuels, pharmaceuticals, and specialty chemicals. The synthetic biology market is expected to grow at a compound annual growth rate (CAGR) of over 25% in the coming years, reflecting the increasing interest in sustainable production methods. As these technologies mature, they are likely to enhance the efficiency and sustainability of biomanufacturing processes, thereby attracting investments and fostering growth within the Next Generation Biomanufacturing Market.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a primary driver of the Next Generation Biomanufacturing Market. As healthcare systems evolve, there is a notable shift towards biologics, which are often more effective and have fewer side effects than traditional pharmaceuticals. According to recent data, the biopharmaceutical market is projected to reach approximately USD 500 billion by 2026, indicating a robust growth trajectory. This surge in demand necessitates advanced biomanufacturing techniques that can efficiently produce complex biologics at scale. Consequently, companies are investing in next generation biomanufacturing technologies to enhance production capabilities, reduce costs, and improve product quality. This trend not only supports the growth of the biopharmaceutical sector but also drives innovation within the Next Generation Biomanufacturing Market.

Regulatory Support for Biomanufacturing

Regulatory support is emerging as a crucial driver for the Next Generation Biomanufacturing Market. Governments and regulatory bodies are increasingly recognizing the importance of biomanufacturing in addressing public health needs and environmental challenges. Initiatives aimed at streamlining the approval processes for biopharmaceuticals and bioproducts are being implemented, which can significantly reduce time-to-market for new innovations. For instance, the introduction of guidelines that facilitate the use of advanced manufacturing technologies is likely to encourage investment in next generation biomanufacturing. This supportive regulatory environment not only fosters innovation but also enhances the competitiveness of the Next Generation Biomanufacturing Market on an international scale.

Focus on Sustainable Manufacturing Practices

The focus on sustainable manufacturing practices is reshaping the Next Generation Biomanufacturing Market. As environmental concerns become more pressing, companies are increasingly adopting biomanufacturing processes that minimize waste and reduce carbon footprints. The integration of renewable resources and the development of biodegradable products are becoming essential components of manufacturing strategies. Data suggests that the market for sustainable biomanufacturing is expected to grow significantly, driven by consumer demand for eco-friendly products. This shift towards sustainability not only aligns with The Next Generation Biomanufacturing Industry as a leader in responsible manufacturing practices.

Integration of Automation and AI Technologies

The integration of automation and artificial intelligence (AI) technologies is transforming the Next Generation Biomanufacturing Market. These technologies enhance operational efficiency, reduce human error, and enable real-time monitoring of biomanufacturing processes. The adoption of AI-driven analytics allows for better decision-making and optimization of production workflows. Market data indicates that the use of AI in biomanufacturing could lead to cost reductions of up to 30% by improving process efficiencies. As companies increasingly recognize the potential of automation and AI, investments in these technologies are likely to accelerate, further driving growth and innovation within the Next Generation Biomanufacturing Market.