Market Analysis

In-depth Analysis of Neural Network Software Market Industry Landscape

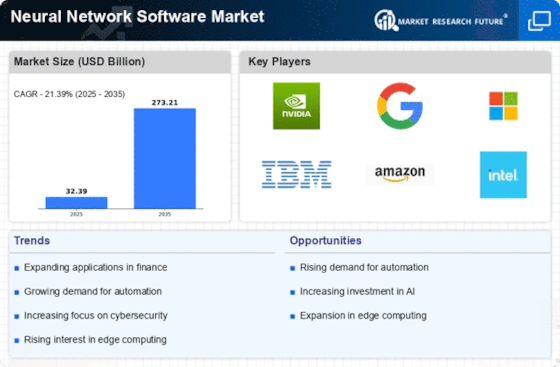

The neural network software market patterns are gradually beginning to conform to the growing demand for state-of the-art AI (ML) and computer based intelligence solutions driven by various industries. Whilst organizations continually explore the utility of neural networks for productivity enhancement through innovation, the market for neural network software is experiencing amazing growth and transformation.

A noteworthy feature observed in the neural network software market is the growing acceptance of deep learning systems. These systems include TensorFlow, PyTorch, and Keras, which are gaining enough ground for their ability to treat complicated neural network models that work with more massive datasets. Companies are adopting these systems to develop use cases for image and speech recognition, natural language processing, and predictive analysis which have resulted in surging demand for neural network software.

The other key pattern could be the design of neural network software for edge processing and IoT devices. Consequently, as the deployment of intelligent systems at the edge increases, demand for smart and economical neural network software is increasing. This progression is stimulated by the necessity for continuous correction and active improvements in areas like self-driving vehicles, smart devices, and industrial automation, which foster growth in the neural network software market.

The market, on the other hand, is experiencing a surge of specifically designed neural network software to perform specific tasks. Organizations are hence shifting towards sector-specific partnerships such as healthcare diagnostics, financial fraud detection, and robotics which cater to the particular needs of different sectors. It implies the growing recognition of the possible implications of artificial neural network software in addressing industry-specific problems and opportunities.

In addition, coordination of neural network software with distributed computing innovations is a very important pattern contributing to this market. Cloud-based neural network stages and services are becoming more popular by the day, providing businesses with a way to access mobile computing resources, for training and deploying neural networks. This behavior is basically due to the increasing popularity of intelligence software as a requirement and the growth of the market for neural network software solutions.

Leave a Comment