Top Industry Leaders in the Network function virtualization Market

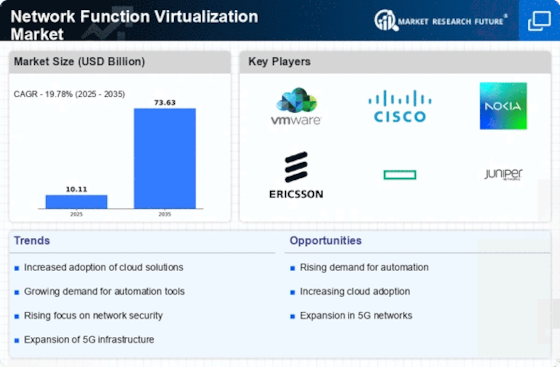

Competitive Landscape of Network Function Virtualization Market:

The Network Function Virtualization (NFV) market has witnessed significant growth in recent years, driven by the increasing demand for flexible and scalable network infrastructure solutions. NFV enables the virtualization of network functions traditionally performed by dedicated hardware, leading to enhanced agility and cost savings for telecom operators and enterprises. As the market continues to evolve, key players are adopting various strategies to gain a competitive edge, and market dynamics are influenced by factors such as technological advancements, strategic partnerships, and evolving customer preferences.

Key Players:

- Nokia Corporation (Finland)

- Juniper Networks (U.S.)

- Accenture PLC (Ireland)

- Cisco Systems Inc. (U.S.)

- Amdocs Inc. (U.S.)

- Alcatel-Lucent S.A. (France)

- Huawei Technologies Co. Ltd. (China)

- NEC Inc. (Japan)

- Intel Corporation (U.S.)

- Connectem Inc. (U.S.)

Strategies Adopted:

- Partnerships and Collaborations: Key players are forming strategic partnerships to expand their product offerings and strengthen their market presence. Collaborations with other technology providers, telecom operators, and industry stakeholders facilitate the development of integrated NFV solutions.

- Focus on Innovation: Continuous innovation remains a critical strategy for market leaders. Companies invest in research and development to introduce advanced NFV solutions that address emerging challenges and meet the evolving demands of customers.

- Global Expansion: To capitalize on the growing demand for NFV solutions worldwide, key players are expanding their geographical presence. This involves establishing a strong network of distributors, resellers, and partners to reach a broader customer base.

- Customized Solutions: Recognizing the diverse requirements of customers, companies are increasingly offering customized NFV solutions. Tailoring products to specific industry needs enhances customer satisfaction and loyalty.

Factors for Market Share Analysis:

- Technological Advancements: The pace of technological advancements in NFV solutions plays a crucial role in determining market share. Companies that consistently introduce cutting-edge technologies and stay ahead of industry trends are likely to capture a larger market share.

- Customer Satisfaction and Retention: High customer satisfaction levels contribute significantly to market share. Companies that focus on delivering reliable, efficient, and scalable NFV solutions gain the trust and loyalty of customers, leading to a stronger market position.

- Strategic Alliances: Partnerships and alliances with other industry players, telecom operators, and technology providers can impact market share. Collaborative efforts often result in comprehensive solutions that appeal to a broader customer base.

- Cost Competitiveness: Pricing strategies and cost-effectiveness of NFV solutions are critical factors influencing market share. Companies that offer competitive pricing without compromising on quality gain a competitive advantage.

New and Emerging Companies:

- Affirmed Networks: This emerging player focuses on providing cloud-native mobile core solutions, catering to the evolving needs of mobile operators in the 5G era.

- A10 Networks: A newcomer in the NFV market, A10 Networks specializes in application networking and security, offering solutions to enhance the performance and security of virtualized networks.

- NetNumber, Inc.: This company specializes in providing centralized signaling and routing control solutions for telecommunication networks, positioning itself as an emerging player in the NFV space.

Current Company Investment Trends:

- 5G Infrastructure: Companies are increasingly investing in the development of NFV solutions that align with the requirements of 5G infrastructure. The transition to 5G networks necessitates advanced virtualization capabilities to support increased data traffic and network complexity.

- Edge Computing: With the rise of edge computing, companies are directing investments toward NFV solutions that can efficiently support edge computing environments. This enables faster processing of data and applications closer to the end-users.

- Security Enhancements: Recognizing the importance of network security, companies are investing in the development of NFV solutions with robust security features. This includes implementing advanced encryption, threat detection, and mitigation capabilities.

- Automation and Orchestration: To streamline network management and enhance operational efficiency, companies are investing in automation and orchestration capabilities within their NFV solutions. This trend aims to reduce manual intervention and optimize resource utilization.

Latest Company Updates:

December 22, 2023: Ciena Corporation announces the launch of its new Ciena Service Assurance platform, which leverages NFV principles for improved network visibility and performance management.

November 15, 2023: VMware and Orange collaborate to develop an NFV-based platform for delivering managed SD-WAN services to enterprises.

October 26, 2023: ETSI releases the latest version of its NFV MANO specifications, focusing on enhanced interoperability and automation capabilities.

September 20, 2023: AT&T announces its successful deployment of a nationwide NFV infrastructure, enabling faster service delivery and improved network efficiency.