Market Trends

Key Emerging Trends in the Nerve Regeneration Market

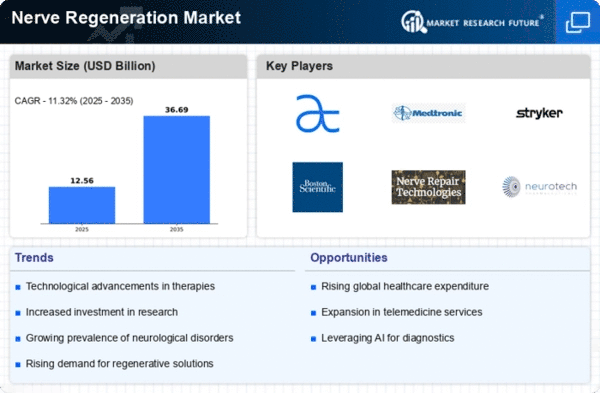

The nerve regeneration market is poised for substantial growth, driven by the increasing incidence of neurological disorders such as Parkinson’s, Alzheimer’s, epilepsy, depression, and essential tremors. The global impact of these disorders is significant, with various statistics underscoring the magnitude of the issue. According to the World Health Organization (WHO), approximately 50 million individuals worldwide were affected by epilepsy in 2017. Alzheimer's Research UK reported that, in 2015, over 46.8 million people globally were grappling with dementia, and this figure was projected to climb to 50 million by 2017. Moreover, predictions indicate a doubling of these numbers every 20 years, reaching 75 million by 2030 and a staggering 131.5 million by 2050.

The economic burden of dementia is substantial, as highlighted by Alzheimer's Disease International, which estimated the total global cost of dementia to be USD 818 billion in 2015, accounting for 1.09% of the global GDP. Furthermore, this cost is anticipated to escalate to an alarming USD 1 trillion. The profound impact of neurological disorders on both individuals and economies underscores the pressing need for advancements in nerve regeneration, thus propelling the growth of the nerve regeneration market.

The rising prevalence of neurological disorders within the population, coupled with the escalating healthcare expenditure dedicated to addressing these conditions, serves as a primary catalyst for the expansion of the nerve regeneration market. The market is expected to experience lucrative growth, driven by the imperative to develop innovative solutions and therapies that can effectively address the challenges posed by neurological disorders.

As research and development efforts intensify, there is a growing focus on nerve regeneration technologies and treatments that can provide meaningful relief to individuals suffering from conditions like Parkinson’s, Alzheimer’s, epilepsy, depression, and essential tremors. The market dynamics are poised for positive transformation as advancements in medical science and technology contribute to the development of novel approaches for nerve regeneration.

In conclusion, the nerve regeneration market is witnessing an upward trajectory, fueled by the alarming rise in neurological disorders globally. The substantial economic and societal impact of these disorders, coupled with the increasing healthcare expenditure, underscores the urgency for innovative solutions. The nerve regeneration market, with its potential for significant advancements, is well-positioned to play a crucial role in addressing the complex challenges associated with neurological conditions and enhancing the quality of life for affected individuals.

Leave a Comment