Market Analysis

In-depth Analysis of Natural Food Additives Market Industry Landscape

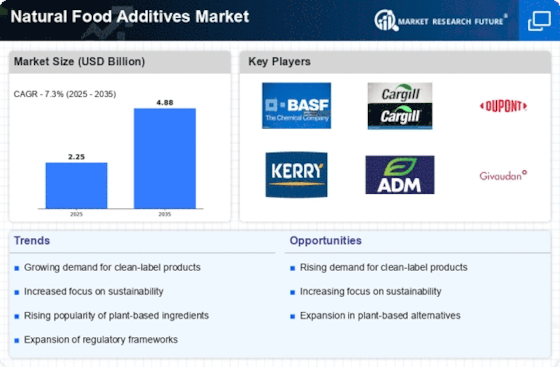

The natural food additives market is characterized by a complex environment that is influenced by a range of variables, including evolving consumer tastes, technical advancements, regulatory policies, sustainability programs, competitive tactics, and changing industry norms. Natural food additives, which come from both plant and animal sources, are becoming increasingly popular as a reaction to changing customer expectations for foods with clearer labels and healthier ingredients. Customer preferences have a major role in influencing the market dynamics for natural food additives. Consumer behavior is clearly shifting in favor of healthy eating habits, which is driving up demand for minimally processed goods with clear ingredient labels. Natural flavors, antioxidants, and plant-based extracts are among the natural additives that consumers prefer in food goods over artificial preservatives and additives. Innovations in food science and technological developments are key factors influencing the dynamics of the natural additives industry. The goal of ongoing research and development is to identify and improve natural additives that can operate as functional replacements for synthetic ones in food compositions. Newer extraction processes, encapsulation technologies, and preservation strategies guarantee the stability, safety, and sensory qualities of natural additives, making it easier to include them into a wider range of food items without sacrificing their nutritional content or quality. Moreover, the market dynamics for natural food additives are greatly influenced by shifting dietary habits and customer lifestyles. The demand for clean-label goods with natural chemicals is rising as people emphasize healthier and more natural food alternatives. Manufacturers may develop and match their product offers to changing customer requirements with the help of these additives. A variety of variables, such as customer desires for healthier alternatives and clearer labeling, technical developments, regulatory concerns, sustainability practices, competitive strategies, and shifting consumer lifestyles, influence the market dynamics of natural food additives. Natural food additives are becoming more and more important in the food sector as customers seek more sustainable and natural food options. This has spurred innovation and changed how different food and beverage items are formulated.

Leave a Comment