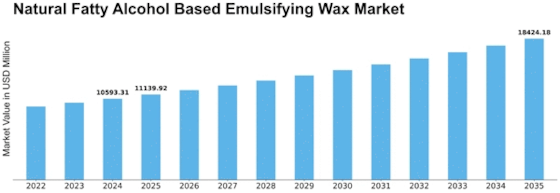

Natural Fatty Alcohol Based Emulsifying Wax Size

Natural Fatty Alcohol Based Emulsifying Wax Market Growth Projections and Opportunities

Natural Fatty Alcohol Based Emulsifying Wax Market Size The natural fatty alcohol-based emulsifying wax market is shaped by various factors that reflect the growing demand for eco-friendly and sustainable ingredients in the cosmetic and personal care industriesThis market segment revolves around the use of emulsifying waxes derived from natural fatty alcohols, offering formulation stability and compatibility with green and clean beauty trendsHere are key market factors influencing the natural fatty alcohol-based emulsifying wax market: Rising Demand for Natural Ingredients: Consumer preferences for natural and plant-based ingredients in cosmetic and personal care products drive the demand for emulsifying waxes derived from natural fatty alcoholsThe trend towards clean beauty supports the growth of this market segment. Eco-Friendly and Sustainable Formulations: The emphasis on sustainability and environmental consciousness fuels the adoption of natural fatty alcohol-based emulsifying waxesCompanies leverage the eco-friendly nature of these waxes to position themselves in alignment with global sustainability goals. Growth in the Cosmetic and Personal Care Industries: The expansion of the cosmetic and personal care industries, driven by changing beauty standards, increased disposable income, and a growing population, contributes to the rising demand for natural emulsifying waxes in formulation processes. Formulation Versatility: Natural fatty alcohol-based emulsifying waxes exhibit versatility in formulations, accommodating various ingredients and textures in cosmetic and personal care productsThis flexibility appeals to formulators seeking stable and effective emulsification. Consumer Awareness and Education: Increasing awareness among consumers about the impact of ingredients on skin health and the environment influences purchasing decisionsThe market benefits from informed consumers seeking products with natural fatty alcohol-based emulsifying waxes. Regulatory Landscape and Clean Beauty Standards: Stringent regulations governing cosmetics and personal care products push companies to adhere to clean beauty standardsNatural fatty alcohol-based emulsifying waxes gain traction as compliant and desirable ingredients, meeting regulatory requirements. Formulator Preferences for Natural Emulsifiers: Formulators in the cosmetic industry prefer natural emulsifiers due to their stability, safety, and compatibility with a wide range of formulationsThe market factors in these preferences, driving the adoption of natural fatty alcohol-based emulsifying waxes. Research and Development Initiatives: Ongoing research and development efforts focus on improving the properties and performance of natural fatty alcohol-based emulsifying waxesInnovations in formulations and production processes contribute to market growth and competitiveness. Clean Label Movement: The clean label movement, emphasizing transparency and simplicity in ingredient lists, influences the marketNatural fatty alcohol-based emulsifying waxes align with the clean label trend, attracting consumers seeking minimalistic and straightforward formulations. Global Economic Trends: Economic conditions impact consumer spending habits and purchasing powerDespite potential economic fluctuations, the demand for natural fatty alcohol-based emulsifying waxes remains resilient as consumers prioritize health-conscious and sustainable choices. Competitive Landscape and Supplier Relationships: The competitive landscape among suppliers of natural fatty alcohol-based emulsifying waxes influences market dynamicsStrong relationships between suppliers and cosmetic companies play a vital role in market positioning and responsiveness to industry trends. Packaging Innovations: Innovations in sustainable packaging solutions further complement the natural fatty alcohol-based emulsifying wax marketCompanies aligning with eco-friendly packaging trends enhance their overall appeal in the market. Global Beauty and Wellness Trends: Evolving beauty and wellness trends on a global scale impact the demand for natural ingredientsThe natural fatty alcohol-based emulsifying wax market is responsive to shifts in consumer perceptions of beauty and wellness.

Leave a Comment