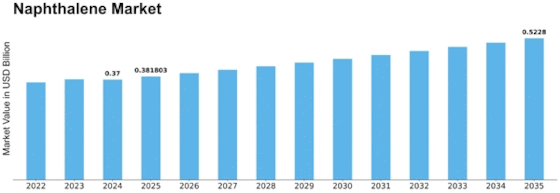

Naphthalene Size

Naphthalene Market Growth Projections and Opportunities

For the Naphthalene Market, several factors combine to determine its progression and development. One of the factors that makes the Naphthalene Market grow is that there are numerous applications of naphthalene in different industries. It is important to note that naphthalene, a solid hydrocarbon derived from coal tar or petroleum, is an essential raw material needed in making phthalic anhydride which in turn can be used for producing various kinds of plastics as well as dyes and resins. The extensive usage in construction, textile and chemical sectors significantly boosts the industry’s growth thus reinforcing the importance of naphthalene as an integral element in diverse industrial processes.

As of 2022, Naphthalene Market Size was estimated at USD 0.35 Billion. The market industry for Naphthalene is projected to reach USD 0.48 Billion by 2032 from USD 0.36 Billion in 2023 exhibiting a compound annual growth rate (CAGR) of 3.7%.

The Naphthalene Market relies heavily on construction industry. Admixtures based on naphthalene are widely used as superplasticizers for concrete formulations so as to improve the workability and reduce water content. With the global emphasis on infrastructure development and sustainable construction practices, the demand for naphthalene in the construction sector is on the rise, directly impacting the market.

Another factor driving this market is textile industry.Naphtalenesulfonate formaldehyde condensates (NSFs), largely employed as dispersants during dyeing cycles within textile production chains are synthesized from naphthalenes.As more efficient and environmentally friendly dyeing solutions are sought by players within this particular sector; demand for dispersants based on naphtalenes continues to rise hence contributing to market expansion.

With increasingly environmentally conscious customers both among individual consumers and industries worldwide, the desire for products that support environmental stewardship is expanding. The market adapts to trends in end-user industries, where the use of naphthalene is integral to achieving efficiency, performance, and sustainability goals.

Price competition and substitutes are some of the factors affecting Naphthalene Market. While considering these alternatives or additives, cost-effectiveness takes into consideration whether naphthalene provides a better option compared to others. Moreover, alternative such as lignosulphonates or polycarboxylate superplasticizers can also have an impact on market dynamics. It adjusts to changes in supply-demand dynamics as indicated by pricing developments, production efficiency and overall cost competitiveness of naphthalene-based products.

Leave a Comment