Top Industry Leaders in the Nanowire Battery Market

Competitive Landscape of Nanowire Battery Market

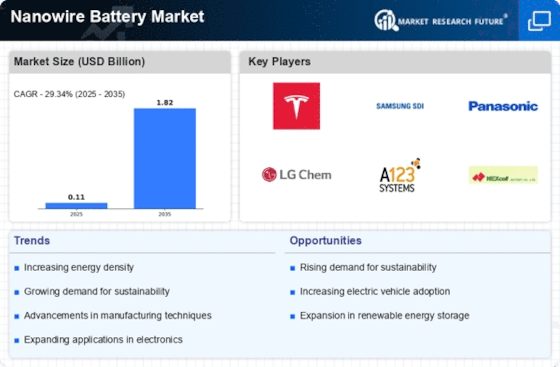

The nanowire battery market, where microscopic filaments hold the key to unlocking energy revolutions. These miniature marvels boast superior performance, promising longer life, faster charging, and enhanced safety compared to traditional lithium-ion batteries. In this electrifying arena, established giants and nimble innovators clash, all vying for a slice of the energy pie. Let's dissect the key strategies and players shaping this captivating battlefield.

Some of the Nanowire Battery companies listed below:

-

Imprint Energy, Inc.

-

Ambri Inc.

-

Xilectric Inc.

-

Amprius Inc.

-

Pellion Technologies

-

Boston Power, Inc.

-

Prieto Battery, Inc.

-

EnerDel. Inc.

-

Envia Systems Inc.

-

Sila Nanotechnologies Inc.

Strategies Adopted by Players:

-

Technological Differentiation: Companies compete fiercely on technological advancements, focusing on factors like higher energy density, faster charging rates, improved cycle life, and enhanced safety features. Developing novel nanowire materials with superior properties, optimizing electrode architectures for efficient charge transfer, and integrating AI-powered battery management systems are key differentiators. -

Diversifying Applications: Moving beyond traditional applications in consumer electronics to address the needs of diverse industries like electric vehicles, grid energy storage, and medical devices unlocks new market segments and drives wider adoption. Developing specialized battery formats and optimizing performance for specific applications are crucial. -

Addressing Cost and Scalability: Making nanowire batteries cost-competitive and easily scalable is vital for widespread adoption. Developing cost-effective manufacturing processes, securing supply chains for key materials, and offering flexible production models are key strategies. -

Building Partnerships and Collaborations: Fostering partnerships with research institutions, materials suppliers, and device manufacturers accelerates innovation, shares expertise, and expands market reach. Collaborating on industry standards, developing pilot projects, and promoting the benefits of nanowire batteries contribute to market growth.

Factors for Market Share Analysis:

-

Revenue Generated: This straightforward metric reflects a company's market penetration and financial strength. -

Number of Nanowire Batteries Produced: Understanding the volume of deployed batteries provides insight into customer adoption and market reach. -

Technology Advancements: Assessing a company's investment in R&D, patent portfolio, and cutting-edge nanowire battery technologies helps gauge its future competitive edge. -

Customer Satisfaction: Analyzing user feedback and loyalty metrics reveals how effectively a company caters to customer needs and builds brand reputation.

Latest Company Updates:

September 2023- Amprius will show off its silicon nanowire battery production line in December. The company is expanding its capacity tenfold at its Fremont site by setting up its unique anode manufacturing process. This will allow Amprius to go from producing batteries in the kilowatt-hour range to megawatt-hours. The extra capacity will supply current customers like Airbus, AeroVironment, BAE Systems and Teledyne FLIR, as well as fulfill the backlog of new customers looking to qualify cells in 2024.

February 2023- Researchers from Carnegie Mellon University and MIT have shown a 3D graphene-nanowire "sandwich" thermal interface that allows for an extremely low thermal resistance of around 0.24 mm2·K/W, which is about 10 times smaller than that of solders and several times lower than thermal greases, gels, and epoxies. This nanostructured heat transfer material can greatly help various electronic systems and devices by letting them work at lower temperatures or at the same temperature but with better performance and higher power density.