Growth in Consumer Electronics

The consumer electronics sector is experiencing a notable transformation, driven by the integration of nanophotonics technologies. The Global Nanophotonics Industry is benefiting from the rising demand for high-resolution displays and advanced imaging systems. Nanophotonic materials are being utilized to enhance display technologies, providing improved color accuracy and energy efficiency. The market for these applications is expected to grow significantly, with projections suggesting an increase in demand for nanophotonic-enabled devices by approximately 25% over the next five years. As manufacturers strive to meet consumer expectations for superior performance and sustainability, the adoption of nanophotonics in consumer electronics is likely to accelerate, contributing to the overall market growth.

Innovations in Healthcare Technologies

The healthcare sector is increasingly recognizing the potential of nanophotonics, which acts as a vital driver for The Global Nanophotonics Industry. Innovations in diagnostic imaging and therapeutic applications are leveraging nanophotonic technologies to enhance precision and efficacy. For instance, the use of nanophotonic sensors in medical diagnostics allows for rapid and accurate detection of diseases at an early stage. The market is anticipated to expand, with estimates indicating a growth rate of around 18% in healthcare applications. As research continues to unveil new possibilities, the integration of nanophotonics in healthcare is likely to revolutionize treatment methodologies, thereby driving further investment and development in the industry.

Emerging Applications in Telecommunications

The telecommunications sector is increasingly adopting nanophotonics technologies, which serves as a crucial driver for The Global Nanophotonics Industry. The demand for faster and more efficient data transmission has led to the exploration of nanophotonic components such as optical switches and modulators. These components are capable of operating at higher speeds and lower power levels compared to traditional technologies. The market is projected to witness substantial growth, with estimates indicating a potential increase in revenue by over 15% annually. As 5G networks continue to roll out globally, the need for advanced nanophotonic solutions will likely intensify, further solidifying the industry's position in the telecommunications landscape.

Technological Advancements in Nanophotonics

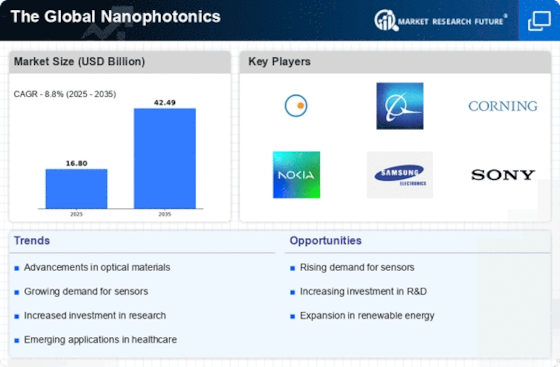

The rapid evolution of nanophotonics technology is a primary driver for The Global Nanophotonics Industry. Innovations in materials and fabrication techniques have led to the development of novel photonic devices that operate at the nanoscale. For instance, advancements in metamaterials and plasmonics have enabled the creation of devices with unprecedented optical properties. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is fueled by the increasing demand for high-performance optical components in telecommunications, consumer electronics, and sensing applications. As research institutions and companies invest heavily in nanophotonics, the industry is likely to witness a surge in new product offerings, further driving market expansion.

Rising Demand for Energy-Efficient Solutions

The increasing emphasis on energy efficiency across various sectors is propelling The Global Nanophotonics Industry. Nanophotonic devices, known for their ability to manipulate light at the nanoscale, offer solutions that can significantly reduce energy consumption. For example, nanophotonic solar cells have shown potential in enhancing light absorption, thereby improving the efficiency of solar energy conversion. The market for these devices is expected to expand as industries seek sustainable alternatives to traditional energy sources. Reports indicate that the integration of nanophotonics in energy systems could lead to a reduction in energy costs by up to 30%. This trend aligns with global initiatives aimed at reducing carbon footprints and promoting renewable energy technologies.