Nanocellulose Size

Nanocellulose Market Growth Projections and Opportunities

The Nano cellulose market is interrelated and compounded by a range of factors that stimulate the market’s development and dynamics. Consumers’ greater awareness regarding making conscious choices along with a growing market for the eco-friendly products across many sectors is another vital aspect of the market. Atas Nanocellulose terbukukan dari sumber lunak seperti kulit kayu sekali gus tidak khas keringkatkan campuran penoplast itu dengan perpaduan silikon. Awareness to environmental issues is increasing by day, and its cause is that industries are looking for alternative solutions; consequently, nanocellulose is emerging in applications like package, textiles and biomedical products.

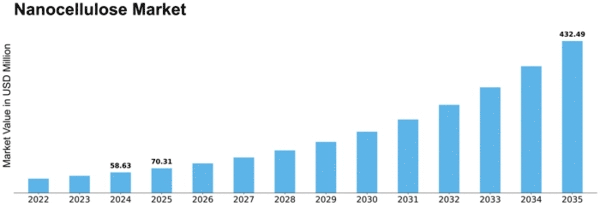

In 2022, the nanocellulose Revenue Scale was valued at USD 0.034 Billion. The nanocellulose market is likely to elegiate from USD 0.064 M to 1.1 B by 2023 and will exhibit CAGR of 19.9% between year 2030.

Besides, research and development have now been enhanced in nanotechnology and they signify powerful forces in the growth of these markets too. Improving existing applications, finding new uses, and developing engineering techniques grantee an insuperable flexibility for nanocelluloses, the foundation for a multitude of new applications. The existence of researching projects on the way to optimize the procedures and understand the novelty of nanocellulose play a role in the widening of the market.

The nanocellulose technology which is critically affecting the market’s potential also plays a key role in this. With the advancement of technology, what was once earlier the ability to make nanocellulose has become easier by manufacturers which implies they are able to produce nanocellulose with improved properties making it more adaptable to an array of industrial applications. Introducing high-performance nanocellulose types at the production process and using the latest methods improve the market efficiency and attract many various end-user industries.

Also, the setting of regulatory norms is another factor that determines the ecosystem of Nanocellulose market. Strict environmental regulations and business policies which support green technologies are what pushes the industry to adopt environmentally friendly nanocellulose as fast-growing material. Regulatory policies and the development of the sector can support R and D process, which leads to stronger market for nanotechnology.

The economic milieu is also extremely pivotal and effective in the industry of nanocellulose. Economic issues, as the prices for the raw materials fluctuate as well as the market in general, influence the prices for nano-cellulose products and the costs of production. Market players should be ready to respond to these cyclic character of the economic factors to stay competitive and sustainable for long term goals.

Nanocellulose is highly dependent on global alliances and labor communications both in factories and among market players becoming crucial market factors. In view of the expanding market, partnership among research centers, industry dwellers, and government agencies is important for knowledge sharing, technology transfer, and effective ability to cooperate in overcoming challenges. Joint ventures can speed up nanocellulose applications development and thus create an atmosphere that will let the businesses grow on the markets’ grounds.

Leave a Comment