Increased Focus on Risk Management

The heightened focus on risk management within the music industry significantly influences the Musical Instrument Insurance Market. Musicians and organizations are becoming more aware of the potential risks associated with instrument ownership, including damage during transport or performance. This awareness drives the demand for comprehensive insurance policies that address these specific risks. Industry reports indicate that musicians are increasingly seeking coverage that includes protection against accidental damage, loss during travel, and liability coverage for performances. As the understanding of risk management deepens, it is likely that more musicians will prioritize insurance as an essential component of their professional toolkit, thereby fostering growth in the insurance market.

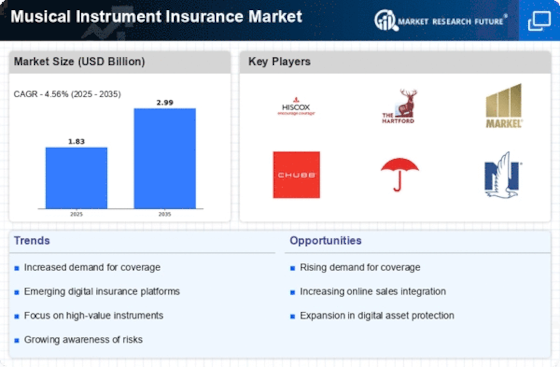

Rising Value of Musical Instruments

The increasing value of musical instruments, particularly vintage and high-end models, drives the demand for the Musical Instrument Insurance Market. As musicians and collectors invest significant amounts in their instruments, the need for protection against theft, damage, or loss becomes paramount. Reports indicate that the market for high-value instruments has expanded, with some vintage guitars fetching prices exceeding hundreds of thousands of dollars. This trend suggests that musicians are more inclined to seek insurance coverage that reflects the true value of their instruments, thereby propelling the growth of the insurance market. Furthermore, as the appreciation for unique and rare instruments continues, the potential for insuring these assets becomes increasingly attractive, leading to a more robust insurance market tailored to the needs of musicians.

Expansion of Music Festivals and Events

The expansion of music festivals and events worldwide plays a crucial role in the growth of the Musical Instrument Insurance Market. As the number of festivals and live performances increases, so does the need for musicians to protect their instruments during these events. Many festivals require performers to have insurance coverage, which further drives demand for musical instrument insurance. The rise in outdoor events and touring musicians has led to a greater emphasis on safeguarding instruments against potential risks such as theft or damage. This trend suggests that as the live music scene continues to flourish, the insurance market will likely see a corresponding increase in policy uptake among musicians and event organizers.

Growing Participation in Music Activities

The rising participation in music-related activities, including lessons, performances, and community events, contributes to the expansion of the Musical Instrument Insurance Market. As more individuals engage in music, whether as hobbyists or professionals, the number of instruments in use increases. This surge in instrument ownership correlates with a heightened awareness of the risks associated with instrument damage or theft. Data suggests that music education programs and community initiatives have seen a significant uptick, leading to a larger demographic of instrument users. Consequently, this growing base of musicians is likely to seek insurance solutions that cater to their specific needs, thereby enhancing the overall market for musical instrument insurance.

Technological Advancements in Insurance Solutions

Technological advancements are reshaping the landscape of the Musical Instrument Insurance Market. The integration of digital platforms and mobile applications allows for more streamlined processes in obtaining insurance coverage. Insurers are increasingly utilizing technology to offer tailored policies that meet the unique needs of musicians. For instance, online platforms enable users to easily assess the value of their instruments and receive quotes in real-time. This shift towards digital solutions not only enhances customer experience but also broadens access to insurance products. As technology continues to evolve, it is anticipated that the insurance market will further innovate, potentially leading to more competitive pricing and diverse policy options for musicians.