Top Industry Leaders in the Multi-Function Display Market

Strategies Adopted:

Technological Innovation: Key players in the MFD market continually invest in research and development to enhance display resolution, processing power, and functionality, enabling advanced features such as enhanced vision, terrain awareness, and integration with other avionics systems.

Customization and Integration: MFD manufacturers focus on providing customizable solutions and seamless integration with existing cockpit systems, offering flexibility to operators and enhancing overall cockpit efficiency.

Regulatory Compliance: Compliance with aviation regulations and industry standards, such as FAA and EASA requirements for cockpit displays and avionics, is a critical aspect of strategy for MFD manufacturers, ensuring product acceptance and market access.

Customer Support and Service: Providing comprehensive customer support, training programs, and aftermarket services is essential for MFD manufacturers to build long-term relationships with operators and maintain customer satisfaction.

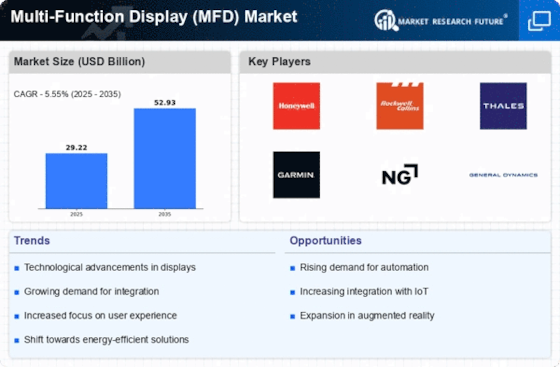

Key Players

United Technologies Corporation (US)

Saab AB (Sweden)

BAE Systems (UK)

Thales Group (France)

Garmin Ltd (US)

Barco (Belgium)

FLIR Systems (US)

Northrop Grumman Corporation (US)

Honeywell International, Inc. (US)

Lockheed Martin Corporation (US)

Factors for Market Share Analysis:

Product Performance and Reliability: MFD manufacturers differentiate themselves based on the performance, reliability, and durability of their products, influencing operators' purchasing decisions and market share.

Affordability and Value Proposition: Cost-effective solutions offering a favorable balance between price and performance are attractive to operators, especially in the highly competitive MFD market.

Regulatory Compliance and Certification: Meeting regulatory requirements and obtaining certifications from aviation authorities are essential for market acceptance and adoption of MFDs by aircraft manufacturers and operators.

New and Emerging Companies:

Astronautics Corporation of America: Astronautics offers MFD solutions for commercial, military, and rotary-wing aircraft, focusing on ruggedness, versatility, and advanced features tailored to diverse mission requirements.

Universal Avionics: Universal Avionics specializes in avionics systems, including MFDs, with a focus on cockpit modernization, integration capabilities, and enhanced situational awareness for pilots.

Industry News and Current Company Investment Trends:

Enhanced Connectivity and Data Integration: MFD manufacturers are investing in connectivity solutions and data integration capabilities to enable real-time data sharing, communication, and collaborative decision-making in the cockpit.

Advanced Display Technologies: The adoption of advanced display technologies such as OLED, LCD, and LED-backlit displays is increasing in MFDs, offering improved clarity, brightness, and contrast for enhanced readability and visual performance.

Integration with Next-Generation Avionics: MFDs are increasingly integrated with next-generation avionics systems, including flight management systems (FMS), navigation systems, and autopilot systems, to provide seamless operation and enhanced functionality for pilots.

Overall Competitive Scenario:

The MFD market is characterized by intense competition, driven by technological innovation, regulatory requirements, and evolving customer needs. Key players differentiate themselves through product performance, customization capabilities, and customer support services. New entrants and emerging companies focus on niche markets, innovative features, and cost-effective solutions to gain traction in the competitive landscape. Collaboration with aircraft manufacturers, airlines, and regulatory authorities is essential for MFD manufacturers to navigate regulatory challenges, expand market presence, and maintain competitiveness in the dynamic aviation industry.