- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

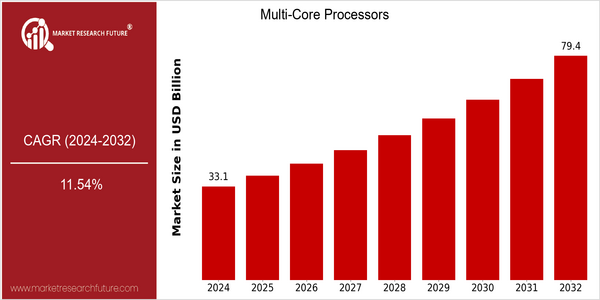

| Year | Value |

|---|---|

| 2024 | USD 33.11 Billion |

| 2032 | USD 79.37 Billion |

| CAGR (2024-2032) | 11.54 % |

Note – Market size depicts the revenue generated over the financial year

Multi-core processors are on the road to rapid growth. The market is worth $33.1 billion in 2024, and is projected to be worth $79 billion in 2032. This robust growth rate represents a CAGR of 11.54% for the forecast period. The growth is being driven by the increasing demand for high-performance computing, which is mainly a result of the development of artificial intelligence, machine learning and data analytics. The need for complex calculations and real-time data processing is leading to a growing demand for multi-core processors capable of handling parallel processing tasks. Further market growth is being driven by technological developments, including the development of energy-efficient architectures and chip designs. Intel, AMD and Nvidia are investing heavily in the development of multi-core solutions. Strategic initiatives, such as the establishment of joint ventures with cloud service providers and investments in next-generation semiconductors, are also having an impact on the market. These efforts are not only enhancing product offerings, but also contributing to the development of edge and IoT applications. Multi-core processors are thus ensuring that they will play a key role in the development of future technological innovations.

Regional Market Size

Regional Deep Dive

The Multi-Core Processors Market is gaining significant momentum in the various regions, driven by the increasing demand for high-performance computing and technological advancements. In North America, the market is characterized by the strong presence of leading technology companies and a robust environment for innovation. Europe is experiencing a rise in the demand for energy-efficient and multi-core processors, while Asia-Pacific is developing rapidly and is becoming a major manufacturing hub. The Middle East and Africa are gradually adopting multi-core processors, driven by the increasing digital transformation initiatives. Latin America is also gaining momentum, mainly in the gaming and mobile computing segments, as the penetration of the Internet and the use of smartphones increases.

Europe

- The European Union has launched the Digital Compass initiative, which aims to increase the region's digital capabilities, including investments in advanced semiconductor technologies, thereby boosting the multi-core processors market.

- Companies like ARM Holdings are leading the charge in developing energy-efficient multi-core processors, catering to the growing demand for sustainable technology solutions in Europe.

Asia Pacific

- China's government has implemented policies to support the domestic semiconductor industry, encouraging local companies to develop advanced multi-core processors, which is expected to enhance the region's manufacturing capabilities.

- Tech giants like Samsung and TSMC are ramping up production of multi-core processors, focusing on cutting-edge technologies such as 5nm and 3nm processes, which are anticipated to set new benchmarks in performance.

Latin America

- Brazil is seeing a rise in the gaming industry, which is driving demand for high-performance multi-core processors, as local developers seek to create more sophisticated gaming experiences.

- Government initiatives aimed at improving digital infrastructure are expected to enhance the adoption of multi-core processors in various sectors, including education and healthcare.

North America

- The U.S. government has initiated several programs to promote semiconductor manufacturing, including the CHIPS Act, which aims to bolster domestic production of multi-core processors and reduce reliance on foreign supply chains.

- Major companies like Intel and AMD are investing heavily in R&D for next-generation multi-core processors, focusing on enhancing performance and energy efficiency, which is expected to drive innovation in the market.

Middle East And Africa

- Countries in the Middle East, such as the UAE, are investing in smart city projects that require advanced computing capabilities, driving demand for multi-core processors in various applications.

- Local startups are emerging in the tech space, focusing on developing software solutions that leverage multi-core processors, which is expected to foster innovation and growth in the region.

Did You Know?

“Did you know that multi-core processors can significantly improve the performance of applications by allowing multiple processes to run simultaneously, which is particularly beneficial for tasks like video editing and gaming?” — Intel Corporation

Segmental Market Size

Multi-Core Processors play an important role in the market for computer systems, which is experiencing a steady growth, mainly driven by the increasing demand for high-speed computing and parallel processing. Artificial intelligence, which requires a lot of computing power, is a driving force in this development, as is the need for more efficient data processing in cloud environments. And developments in the semiconductor industry are also contributing to the development of more powerful and more energy-efficient multi-core processors. Intel and AMD are currently the market leaders, and in the USA and the Asia-Pacific region they are the most widely used multi-core processors. Data centres, game consoles and mobile devices are the main areas of application. These are also influenced by the increasing trend towards working at home and the growing importance of cloud services. Multi-Core Processors are also being influenced by developments in heterogeneous computing and integrated graphics, which make them more versatile and capable of handling a wider range of tasks.

Future Outlook

The market for multi-core processors will be worth $33.1 billion in 2024 and will rise to $79 billion by 2032, a CAGR of 11.5 percent. This growth is being driven by the rising demand for high-performance computing in many areas, including artificial intelligence, cloud computing, and gaming. These applications are becoming more complex and data-intensive, so they require ever-faster processing. This is where multi-core architectures come in, with their enhanced parallel processing and energy-efficiency. The integration of heterogeneous computing and the development of advanced semiconductor materials will also enhance the performance and efficiency of multi-core architectures. The growing importance of edge computing and the Internet of Things will also be a boon for multi-core processors, as these applications require powerful processing to handle the huge volumes of data they generate. Multi-core architectures will account for more than 70 percent of the market by 2032, driven by the need to meet the requirements of next-generation applications and workloads. Multi-core architectures will continue to evolve as companies place ever-greater emphasis on performance and efficiency.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 25.8 Billion |

| Market Size Value In 2023 | USD 29.23 Billion |

| Growth Rate | 13.30% (2023-2032) |

Multi-Core Processors Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.