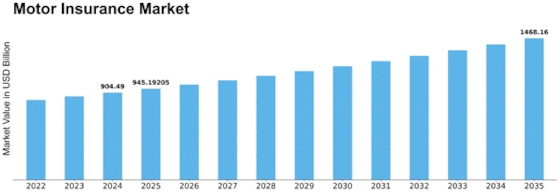

Motor Insurance Size

Motor Insurance Market Growth Projections and Opportunities

The motor insurance market is a dynamic and ever-evolving sector that plays a crucial role in the broader insurance industry. At its core, motor insurance provides financial protection to vehicle owners in the event of accidents, theft, or other unforeseen incidents. The market dynamics of motor insurance are influenced by various factors that shape its growth, pricing, and overall competitiveness.

One key driver of market dynamics is the economic environment. Economic conditions, such as GDP growth, unemployment rates, and consumer spending, directly impact the demand for motor insurance. During periods of economic prosperity, there is often an increase in vehicle ownership, leading to a higher demand for insurance coverage. Conversely, economic downturns may result in reduced consumer spending on non-essential services like comprehensive insurance coverage, affecting market dynamics.

Technological advancements also play a significant role in shaping the motor insurance market. The advent of telematics, for instance, has enabled insurers to gather real-time data on driving behavior. This data-driven approach allows insurers to assess risks more accurately and offer personalized premium rates, thereby enhancing market competitiveness. Additionally, the rise of insurtech companies has introduced innovative solutions, such as usage-based insurance and online platforms, transforming the traditional landscape of motor insurance.

Regulatory changes are another crucial aspect influencing market dynamics. Government regulations, such as mandatory third-party liability coverage, set the minimum requirements for motor insurance. Changes in these regulations can impact the pricing structure, market entry barriers, and overall competitiveness within the industry. Insurers must stay abreast of evolving regulatory landscapes to adapt their strategies and remain compliant.

Competitive dynamics within the motor insurance market are shaped by the behavior of market participants. Insurers compete for market share through various strategies, including pricing, coverage options, and customer service. The rise of aggregator websites and comparison platforms has intensified competition, empowering consumers to easily compare and choose policies based on their preferences. This increased transparency has forced insurers to differentiate themselves through innovative offerings and enhanced customer experiences.

Claims experience and risk management are fundamental to the functioning of the motor insurance market. Insurers closely monitor claims data and continuously refine their risk assessment models to maintain profitability. Factors such as the frequency and severity of claims, as well as emerging trends in accident patterns, influence pricing strategies and underwriting practices. Insurers that effectively manage risk can maintain a competitive edge in the market and better withstand economic uncertainties.

Consumer behavior also contributes to the market dynamics of motor insurance. Changing preferences, such as a growing interest in eco-friendly vehicles or a preference for digital interactions, influence insurers' product development and distribution strategies. Additionally, consumer awareness of the importance of insurance coverage and the ability to access information easily impact market dynamics, driving insurers to invest in marketing and education initiatives.

In conclusion, the motor insurance market is a multifaceted arena shaped by economic conditions, technological advancements, regulatory changes, competitive strategies, claims experience, and consumer behavior. Insurers must navigate these dynamic factors strategically to stay relevant and competitive in an industry that continually adapts to the evolving needs of vehicle owners and the broader economic landscape.

Leave a Comment