Top Industry Leaders in the Motor Control Centers Market

*Disclaimer: List of key companies in no particular order

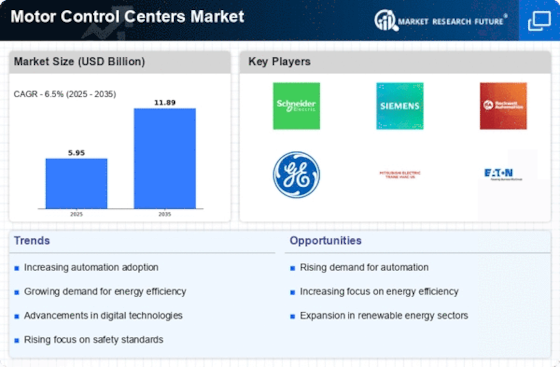

The Motor Control Centers (MCCs) market stands as a pivotal component within the intricate machinery of global industries. Functioning as the orchestrators of electric motor operations, these control centers play a crucial role in ensuring seamless and efficient power utilization across diverse sectors such as oil & gas, water treatment, mining, and manufacturing. The competitive panorama of this market is dynamic, with established industry leaders contending for supremacy alongside innovative newcomers who are carving out new niches.

Key Players and Their Strategies:

Prominent players shaping the landscape of the Motor Control Centers market include ABB (Switzerland), Mitsubishi Electric (Japan), Siemens (Germany), Schneider Electric (France), WEG (Brazil), Powell (US), Rockwell Automation (US), Eaton (Ireland), Marine Electricals (India), Ingeteam S.A. (US), Allis Electric Co Ltd (Taiwan), Myers Power Products, Inc. (US), Wescosa (Saudi Arabia), and others.

-

Established Giants: Global industrial powerhouses like ABB, Siemens, Schneider Electric, Eaton, and Rockwell Automation command significant market shares. Their strategies pivot around diversification across product segments (conventional and intelligent MCCs), geographic expansion, and strategic acquisitions to fortify their portfolios. For instance, ABB's recent acquisition of GE Industrial Solutions' electrification business strengthens its foothold in North America.

-

Regional Champions: Companies such as Fuji Electric, WEG, and Mitsubishi boast strong footholds in their respective regions. They rely on localized manufacturing, cost-competitive offerings, and an in-depth understanding of regional regulations and customer needs to compete effectively. WEG, for instance, caters to the specific high-voltage demand in South America.

-

Emerging Disruptors: Startups and smaller players are entering the arena with innovative technologies, including cloud-based monitoring, artificial intelligence-powered predictive maintenance, and modular MCC designs. These offerings cater to the growing demand for smart and flexible solutions, especially in automation-driven industries. Companies like Beckhoff Automation and Eaton's Intelligent MCC System are at the forefront of spearheading this trend.

Factors for Market Share Analysis:

Several factors play a crucial role in dissecting the market share dynamics in the Motor Control Centers landscape:

-

Product Portfolio: Offering a comprehensive range of MCCs for various voltage ratings, applications, and functionalities is crucial. Players with diverse portfolios like Schneider Electric cater to a wider clientele, while those specializing in niche segments like WEG in high voltage can carve out strong positions.

-

Technological Advancements: Investing in Research and Development (R&D) for energy efficiency, remote monitoring, and intelligent features like self-diagnostics is key to differentiation. Companies like Siemens with its MindSphere cloud platform and Eaton's Intelligent Motor Control solution are leading the charge.

-

Brand Reputation and Reliability: Trust and expertise are paramount in this safety-critical market. A long history of reliable performance and strong customer service, as seen with ABB and Mitsubishi, can be a significant competitive advantage.

-

Geographical Presence: Having a global footprint with manufacturing and service networks closer to customers is vital for timely delivery and support. Companies like Schneider Electric with its extensive global network excel in this aspect.

-

Price Competitiveness: Balancing cost with quality is essential for wider market penetration. Regional players like WEG often have a cost advantage over global giants, making them attractive in price-sensitive segments.

Emerging Trends and Company Strategies:

Several emerging trends promise to reshape the competitive landscape in the Motor Control Centers market:

-

Smart MCCs: The integration of Internet of Things (IoT), Artificial Intelligence (AI), and cloud technologies for remote monitoring, predictive maintenance, and optimized energy management is transforming the market. Companies like Siemens and Eaton are actively developing solutions in this space.

-

Modular Designs: The increasing demand for flexibility and easier customization is driving the development of modular MCCs with plug-and-play components. Beckhoff Automation, with its scalable XPlan modular system, is a prominent example.

-

Sustainability Focus: Eco-friendly considerations like energy efficiency and minimized environmental impact are gaining traction. Companies are incorporating renewable energy sources and energy-saving features into their MCCs. Schneider Electric's Green Premium program exemplifies this trend.

-

Digitalization and Integration: Seamless integration with industrial automation systems and digital platforms is becoming crucial. Companies are working on open communication protocols and data connectivity solutions to facilitate this. Rockwell Automation's FactoryTalk platform is a noteworthy example.

Overall Competitive Scenario:

The Motor Control Centers market is characterized by intense competition but also presents significant growth opportunities. Established players leverage their experience and brand recognition, while new entrants bring innovation and agility. Technological advancements, regional dynamics, and evolving customer needs will continue to reshape the competitive landscape. Companies that adapt to these changes and offer smart, sustainable, and cost-effective solutions will be well-positioned to thrive in this dynamic market.

Industry Developments and Latest Updates:

ABB:

- On October 26, 2023, ABB unveiled the TerraGear MCCs designed for low-voltage applications in challenging environments such as oil & gas and mining. (Source: ABB press release)

- Announced on September 12, 2023, ABB has entered into a partnership with Rockwell Automation for the collaborative development and marketing of MCCs in North America. (Source: ABB website)

Mitsubishi Electric:

- Revealed on November 15, 2023, Mitsubishi Electric introduced the MELCO MCC series, featuring enhanced safety features and communication capabilities. (Source: Mitsubishi Electric website)

- On July 20, 2023, Mitsubishi Electric released a white paper titled "Optimizing Motor Control Centers for Energy Efficiency." (Source: Mitsubishi Electric website)

Siemens:

- Demonstrated on December 5, 2023, Siemens showcased the SIRIUS MCCs at the Automation Expo India, featuring integrated intelligence and cloud connectivity. (Source: Siemens website)

- Announced on September 27, 2023, Siemens introduced an update to the Sinamics G120C converter series tailored for use with MCCs in industrial applications. (Source: Siemens website)

Schneider Electric:

- Introduced on November 30, 2023, Schneider Electric presented the PowerPact MCCs, offering advanced protection and communication options tailored for data centers. (Source: Schneider Electric website)

- Launched on August 10, 2023, Schneider Electric unveiled the TeSys MCCs, designed for simple and efficient motor control in building automation. (Source: Schneider Electric website)