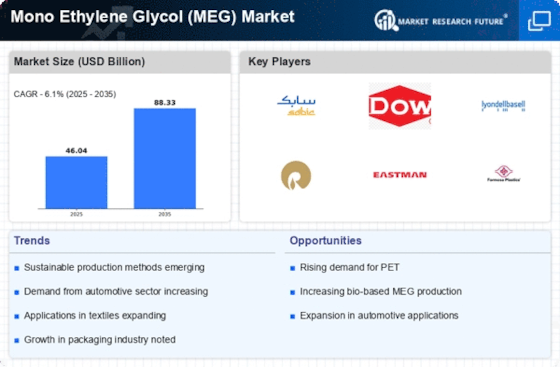

Growth in Automotive Applications

The automotive sector is increasingly adopting Mono Ethylene Glycol Market for various applications, particularly in antifreeze and coolant formulations. MEG's properties, such as low freezing point and high boiling point, make it an ideal choice for enhancing vehicle performance and safety. As the automotive industry evolves with a focus on efficiency and sustainability, the demand for high-quality coolants is expected to rise. Current data suggests that the automotive sector could account for approximately 20% of the overall MEG consumption. This growth in automotive applications is likely to bolster the Mono Ethylene Glycol Market (MEG) Market, as manufacturers seek reliable solutions to meet stringent performance standards.

Expansion of the Chemical Industry

The expansion of the chemical industry is a key driver for the Mono Ethylene Glycol Market . serves as a fundamental building block for various chemical processes, including the production of solvents, resins, and plasticizers. As the chemical industry continues to grow, driven by increasing industrialization and urbanization, the demand for MEG is expected to rise correspondingly. Recent data suggests that the chemical sector could see a growth rate of approximately 5% annually, which would directly impact the consumption of MEG. This expansion presents a promising opportunity for the Mono Ethylene Glycol Market , as manufacturers seek to meet the rising demand for diverse chemical products.

Increasing Use in Packaging Materials

The Mono Ethylene Glycol Market is witnessing a significant uptick in the use of MEG in the production of packaging materials. MEG is utilized in the manufacture of polyethylene terephthalate (PET), which is a widely used plastic in food and beverage packaging. As the demand for sustainable and recyclable packaging solutions grows, the role of MEG in producing PET becomes increasingly vital. Current trends indicate that the packaging sector is projected to grow at a compound annual growth rate of around 4%, further driving the demand for MEG. This shift towards sustainable packaging solutions is likely to enhance the Mono Ethylene Glycol Market as companies adapt to consumer preferences for eco-friendly products.

Rising Demand from the Textile Industry

The Mono Ethylene Glycol Market is experiencing a notable surge in demand from the textile sector. MEG is a crucial component in the production of polyester fibers, which are extensively used in clothing and home textiles. As consumer preferences shift towards synthetic fabrics due to their durability and cost-effectiveness, the textile industry is projected to grow significantly. Reports indicate that the textile sector accounts for a substantial portion of MEG consumption, with estimates suggesting that it could represent over 60% of the total demand. This trend is likely to continue as the global population increases and the demand for clothing rises, thereby driving the Mono Ethylene Glycol Market further.

Technological Innovations in Production Processes

Technological innovations in the production processes of Mono Ethylene Glycol Market (MEG) are poised to enhance efficiency and reduce costs within the industry. Advances in catalytic processes and the development of more sustainable production methods are likely to improve yield and lower environmental impact. As companies invest in research and development to optimize MEG production, the overall supply chain is expected to become more robust. Current estimates indicate that these innovations could lead to a reduction in production costs by up to 15%, thereby making MEG more accessible to various industries. This evolution in production technology is likely to propel the Mono Ethylene Glycol Market (MEG) Market forward, as it aligns with the growing emphasis on sustainability and cost-effectiveness.